7 Mintos Alternatives for 2021

Mintos is the most popular P2P lending platform in Europe. It’s however not the only one and certainly not the lending platform with the highest returns. Are you wondering which platforms are worth investing in apart from Mintos? These are the best Mintos alternatives with a proven track record and interesting investment products.

Note that some of the statistical data isn’t up to date. Always do your own due diligence about a P2P lending site before investing any funds. Read the latest news about a platform, study their blog and analyse securities and the performance of their loan orginators.

1. Peerberry

Operating since: 2017

Operating since: 2017

Loans funded: > €191 M

Number of investors: > 18.000

Interest paid out: > €1.8 M

Type: short-term loans

Protection: buyback guarantee, extended guarantee

Average loan period: 2 months

Average interest: 11,51%

Minimum investment: €10

Peerberry is my favorite platform when it comes to short-term investments. Even though Mintos also offers the possibility to invest in short-term loans, the amount of investors is often higher than the supply of loans, which can lead in uninvested capital on Mintos – this is valid during normal market conditions. On Peerberry I never had this problem when investing in short-term loans with a loan period of only 1 month. Additionally, Peerberry offers the same buyback guarantee as Mintos and the interest is often higher for a similar type of investment (same buyback means “same terms” – the loan originators backing up the buyback guarantee are different). Also, PeerBerry’s buyback guarantee covers the accrued interest, which isn’t always the case with Mintos. Read more about my experiences in my Peerberry review.

2. EstateGuru

Operating since: 2014

Loans funded: > €187 M

Number of investors: > 43.000

Interest paid out: > €12.6 M

Type: real estate loans

Protection: mortgage, personal guarantee

Average loan period: 12 month

Average interest: 11,8%

Minimum investment: €50

EstateGuru is another suitable Mintos alternative as you are investing in the type of loans, that aren’t always available on Mintos. EstateGuru offers high yield investment opportunities for investors who want to invest in property-backed loans. Meaning instead of the buyback guarantee your investment is protected by real collateral. Even though the loan periods tend to be longer with EstateGuru offers a good way to diversify your portfolio. Additionally, compared to Mintos, EstateGuru hasn’t lost a single cent from investor’s money since it started operating in 2014. All of the defaulted loans had been recovered. Read more about my experience with EstateGuru in my in-depth review or watch my interview with EstateGuru.

3. Crowdestor

Operating since: 2018

Operating since: 2018

Loans funded: not available

Number of investors: > 7,600

Interest paid out: € 10 M

Type: business loans

Protection: collateral

Average loan period: 12 months

Average interest: 15,10%

Minimum investment: €50

Crowdestor offers a bigger variety of business projects. You can invest in all sorts of business, ranging from the renovation of warehouses, development of mobile apps or even business from the energy and hospitality sector. There are also more fresh projects and fewer stage loans as compared to EstateGuru. My average interest on Crowdestor is 16,65% which is significantly higher than on Mintos. Even though Crowdestor doesn’t have an Auto Invest and you need to invest in loans manually, it is very simple to use. Investors that join Crowdestor should be do their own due diligence about the individual projects and the people behind it.

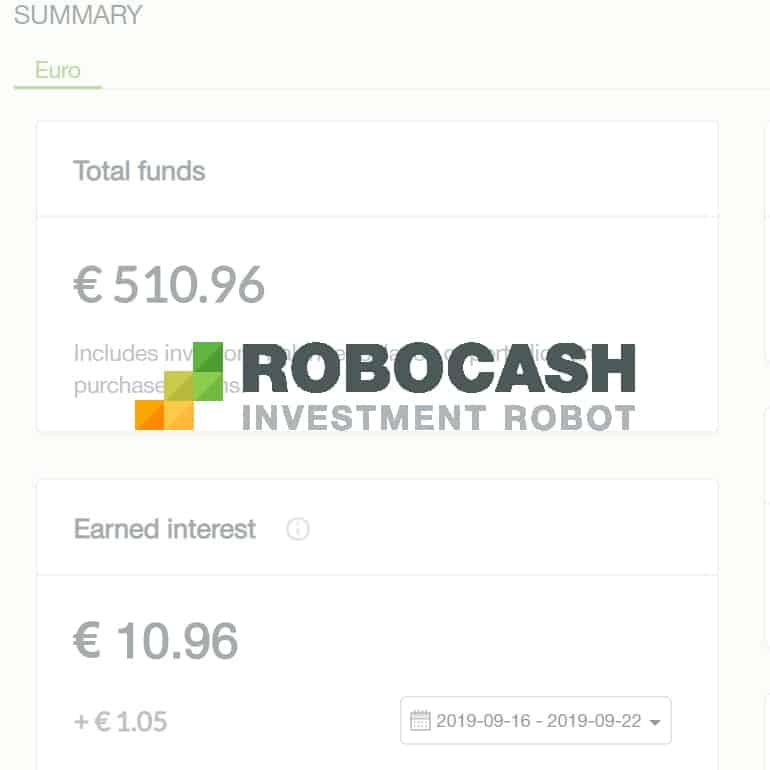

4. Robocash

Operating since: 2017

Operating since: 2017

Loans funded: > €113 M

Number of investors: > 8.010

Interest paid out: > €1.1 M

Type: consumer and commercial loans

Protection: Buyback guarantee on all loans

Average loan period: 48 days ( 7 – 90 days)

Average interest: 12%

Minimum investment: €10

Robocash can be compared with Peerberry at best. The P2P lending site offers the same type of loans, however, issued by other loan originators from other countries. You can, therefore, benefit from short-term investments with a similar interest of 12% while diversifying in other markets. One benefit of Robocash is that their buyback guarantee kicks in already after 30 days compared to 60 days on Peerberry and Mintos. Robocash also offers an Auto Invest with a minimum investment of €10. Even though the P2P lending site doesn’t offer such broad diversification options I only had good experiences with it so far. Note, that Robocash is often subject to cash-drag. Have a look at the availability of investment opportunities before you sign-up.

5. Bondora

Operating since: 2008

Operating since: 2008

Loans funded: > €317 M

Number of investors: > 91,000

Interest paid out: not available

Type: personal loans

Protection: none

Average loan period: 49 months

Average interest: 10,80%

Minimum investment: €1

Bondora is another very popular P2P platform with a huge investor base. The P2P lending site offers possibilities to invest in personal loans ranging from 1 to 60 months. The difference between Mintos and Bondora is that Bondara doesn’t offer investors a buyback guarantee. On the other hand, the possible interest can be up to 200% for individual short-term loans. As there is no protection for your investments on Bondora, your net returns are way lower as the average interest showing in your dashboard. Most investors won’t get more than 11% net returns as they are many default loans. Bondora also offers one of the highest liquidity (during normal market conditions) with their Go and Go product that allows you to withdraw your investments anytime.

and get €5 cashback

6. Bondster

Operating since: 2017

Operating since: 2017

Loans funded: > €41 M

Number of investors: > 8.700

Interest paid out: > €3.8 M

Type: personal and business loans

Protection: Buyback guarantee

Average loan period: 12 months

Average interest: 13,2%

Minimum investment: €10

Bondster is the Czech alternative to Mintos. It’s a suitable platform for anyone who wants to invest in loans through a P2P lending site, that isn’t based in the Baltics. Bondster offers investment opportunities in personal loans from 8 countries and 23 loan originators. If you are already investing on Mintos, I suggest investing in loans from loan originators that don’t list their loans on Mintos. You can find some loan originators on both platforms. Bondster offers a slightly higher average interest, however, when it comes to liquidity, Mintos is well ahead of Bondster. As of this moment, Bondster can be a good way to diversify your P2P portfolio.

7. EvoEstate

Operating since: 2019

Operating since: 2019

Loans funded: > €40 M

Number of investors: > 1.550

Interest paid out: > €7,900

Type: personal and business loans

Protection: Mortgage

Average loan period: 12 months

Average interest: 16,32%

Minimum investment: €50

EvoEstate is a young P2P real estate platform aggregator. It means that with one account you can invest in projects listed on 20 popular European real estate platforms. This way you can build a well-diversified P2P crowdfunding portfolio without investing on multiple platforms. The average interest on EvoEstate is 16,32% which is much higher than on Mintos. EvoEstate is also a good alternative to Mintos as your investments are protected by a mortgage rather than a buyback guarantee. While EvoEstate is still a very young start-up, its business model, as well as their product, make a lot of sense, which is the reason I added the platform to the list of suitable Mintos alternatives for 2020.

How to pick the best Mintos alternative?

It always comes down to your own preferences and your risk profile. You can either go for platforms with higher interest rates and lower liquidity, or platforms that offer higher security with an average return (EstateGuru or EvoEstate) or P2P lending sites that allow you to withdraw your money instantly in exchange for a yield of 6,75% (Bondora Go and Grow).

Here are a few questions that will help you to choose the best Mintos alternative.

❓ How fast can I access my investments?

Every investor has a different investment term in mind. Some investors tend to invest long-term, while others are more interested in short-term investments. Every platform offers a different investment product. Business and real estate loans are more suitable for long-term investors, while short-term payday loans are a better choice for investors that prioritize liquidity.

❓ How is my investment secured?

If you invest in loans on Mintos, you might also like other platforms that offer a buyback guarantee. Note, that it's good practice to also invest in loans that are secured by real collateral such as a mortgage. Platforms such as EstateGuru and EvoEstate help you with that.

❓ How well is my P2P portfolio diversified?

Diversification is important. Never put all your eggs in one basket. Chose platforms that allow you to invest in hundreds of loans. The lower the minimum investment amount, the better your diversification. Remember to diversify not only across platforms but also loan types, loan originators and countries.

Remember that investing in P2P loans is risky and as with every investment, you might lose your money. I suggest diversifying also across other asset classes such as bonds or ETFs. This article is not a piece of investment advice. You alone are liable for your investment decisions.