My Peerberry Auto Invest Settings

Peerberry, the leading P2P lending platform for short-term loans, offers you to automatically invest in loans and let the tool do the work for you. This feature is called the Peerberry Auto Invest. You might probably already heard me talking about this feature in my Peerberry Sign-Up Guide or my Peerberry review.

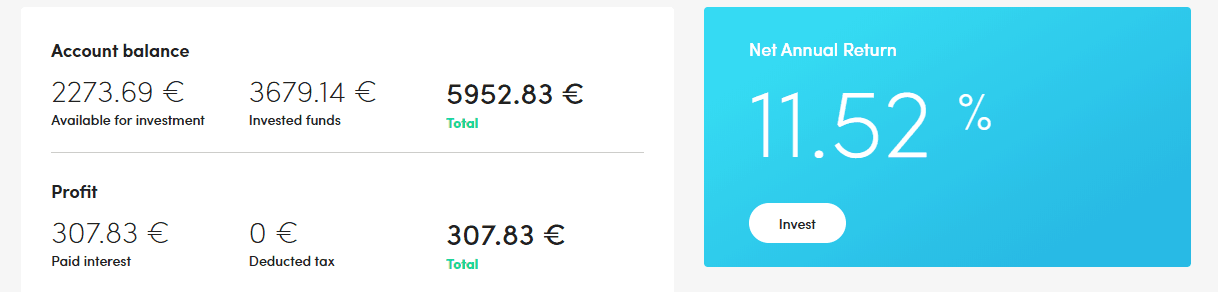

In this article, I will show you how to set up your Peerberry Auto Invest that generates me almost 12% of interest every year with €0 loss (so far).

Usually my Peerberry Auto Invest is set up to invest all of my funds on the P2P lending platform, however, at the moment I am testing how fast I can access my money – that’s why you see over €2.000 available. – The conclusion? I could cash out most of my investments within five weeks which makes PeerBerry the best option for those who emphasize liquidity.Since I wrote this article, my PeerBerry investment increased significantly. Note, however, that the amount of my investments should not influence your investment choice. There are no guarantees for any outcome and you should do your own due diligence before investing your money on any platform.

Set up your Peerberry Auto Invest

In order to access your Auto Invest just click on it in the top menu and create a new Auto Invest portfolio. As soon as you define your settings you will get a quick overview of your automated portfolio.

1. Define your portfolio size

If you want to create multiple portfolios set the limit for your Auto Invest.

2. Define your minimum investment

You can invest from €10 in one loan - the lower the minimum investment the broader your diversification and lower your risk.

3. Choose the countries

Choose markets where you want to invest in loans.

4. Invest in loans with a buyback guarantee

Your late loan will be repurchased from the loan company.

5. Reinvest your returns

Reinvest your returns to benefit from the compound interest effect.

The best Auto Invest settings are those that fit your investment strategy.

My Peerberry Auto Invest Settings

If you are looking for some inspiration on how to set-up your Peerberry Auto Invest, feel free to copy my settings and enjoy the returns.

The Peerberry Auto Invest isn’t by far as complex as the Mintos Auto Invest as there aren’t so many loan types on Peerberry.In theory, you could just choose to invest in loans with a buyback guarantee and let Peerberry know that you want to reinvest your returns.

As for the countries. I have excluded Russia and the Republic of Moldova. It’s rather a personal preference and it isn’t based on any data.

My minimum investment is set to €20, however, you can lower it if you wish. The reason behind this is that in case there aren’t as many loans available I can just increase the invested amount per loan to avoid cash sitting on my Peerberry account.

Peerberry Auto Invest is not working

If your Peerberry Auto Invest isn’t working you need to easy your Auto Invest settings, meaning your criteria are too strict.

Here are a few ideas that might help you resolve your problems with non-working Auto Invest:

- add more countries

- include all loan originators

- increase the minimum investment amount

Also, check whether you did not set a limit for “minimum funds in your account”. This means that Peerberry won’t invest the amount you inserted into this field.

If you save and activate your Peerberry Auto Invest and it still won’t invest your money within 24 hours then get in touch with the Peerberry support (info@peerberry.com). Usually, they respond within a few hours. It can take up to one day to invest your money via Auto Invest as mentioned in this PeerBerry review.

At the end of the day, you shouldn’t spend too much time setting up your Peerberry Auto Invest. There aren’t as many options to choose from. All loans are secured by the buyback guarantee, which will kick in as soon as a payment from the borrower is late for more than 60 days. Since I started investing in Peerberry I haven’t had any default loans, meaning I had no loss (that’s not a guarantee though).

Before blindly copying any investment strategy, I strogly suggest you do your own due diligence about individual loan originators and create your investment strategy based on your own research.

If you have further questions about the Peerberry Auto Invest, comment in the section below this article. I am happy to help.

Hi Jakub,

Firstly thanks for the information and great website.

I recently tried the Peerberry Autoinvest account however I ended up with several different loans with the same LO for the same real estate development. Using the filters provided in Auto Invest I don’t see a way of avoiding this in the future ? any comments appreciated

Regards

Martin

Really interesting question Martin 👏

Usually, the Auto Invest does not invest more than once in a loan on PeerBerry (that’s the case for short-term loans at least). When it comes to real estate loans, it’s a different story since the developer funds the project in stages (similar to what you have on EstateGuru or Crowdestate). If that’s the case, your Auto Invest might invest in different stages of the real estate project. If you want to avoid this, I would just set up the Auto Invest for short-term loans and invest into the real estate loans manually. That’s the only workaround I can think of at the moment.

You should know that PeerBerry is evolving so I think they might come with a filter option in the future that will improve the investing in real estate projects.

Hello Jakub,

What is your criteria when selecting the countries you want to invest in?

Best regards,

Adrian

On PeerBerry, I invest in what’s available. There’s no statistical data that you could use to make educated selection of countries on PeerBerry.