Revolut Metal Card Review – Is it Worth it?

- Best exchange rates for over 150 currencies

- No-fee ATM withdrawals up to £600 per month

- Only £9.66 per month (annual plan)

Table of Content

I have been using the Revolut Metal card as my main card for over a year now and I got to confess to you – I really got hooked into it. Continue reading this Revolut Metal review to find out what I think about this Revolut plan.

Initially, I wasn’t convinced that Revolut Metal is worth the money; however, with the ongoing improvements to their Revolut Metal plan, the value for money is much better as you would expect.

In this Revolut Metal card, I will introduce you to all the perks, benefits, and features of the Revolut Metal plan and how it compares to other offers.

Let’s jump right into it.

Revolut Metal Advantages

The Revolut Metal card comes with tons of benefits such as:

- Best exchange rates for over 150 currencies

- Exchanging in 28 fiat currencies without limits

- No-fee ATM withdrawals in any currency up to £600 per month

- Overseas medical insurance

- Delayed baggage and delayed flight insurance

- Global express delivery

- Borrowing money

- Vaults

- Metallic debit card

- Disposable virtual cards

- LoungeKey Pass access

- No-fee lounge passes for you and three friends if your flight is delayed >1 hour

- Discounts with Revolut Metal Perks

- 1% cashback on all card payments

- Up to 5 junior accounts for kids

As you can see, the Revolut Metal plan targets a rather broad customer base.

It’s not only for travelers or business people but also for parents looking to teach their kids how to manage their budgets.

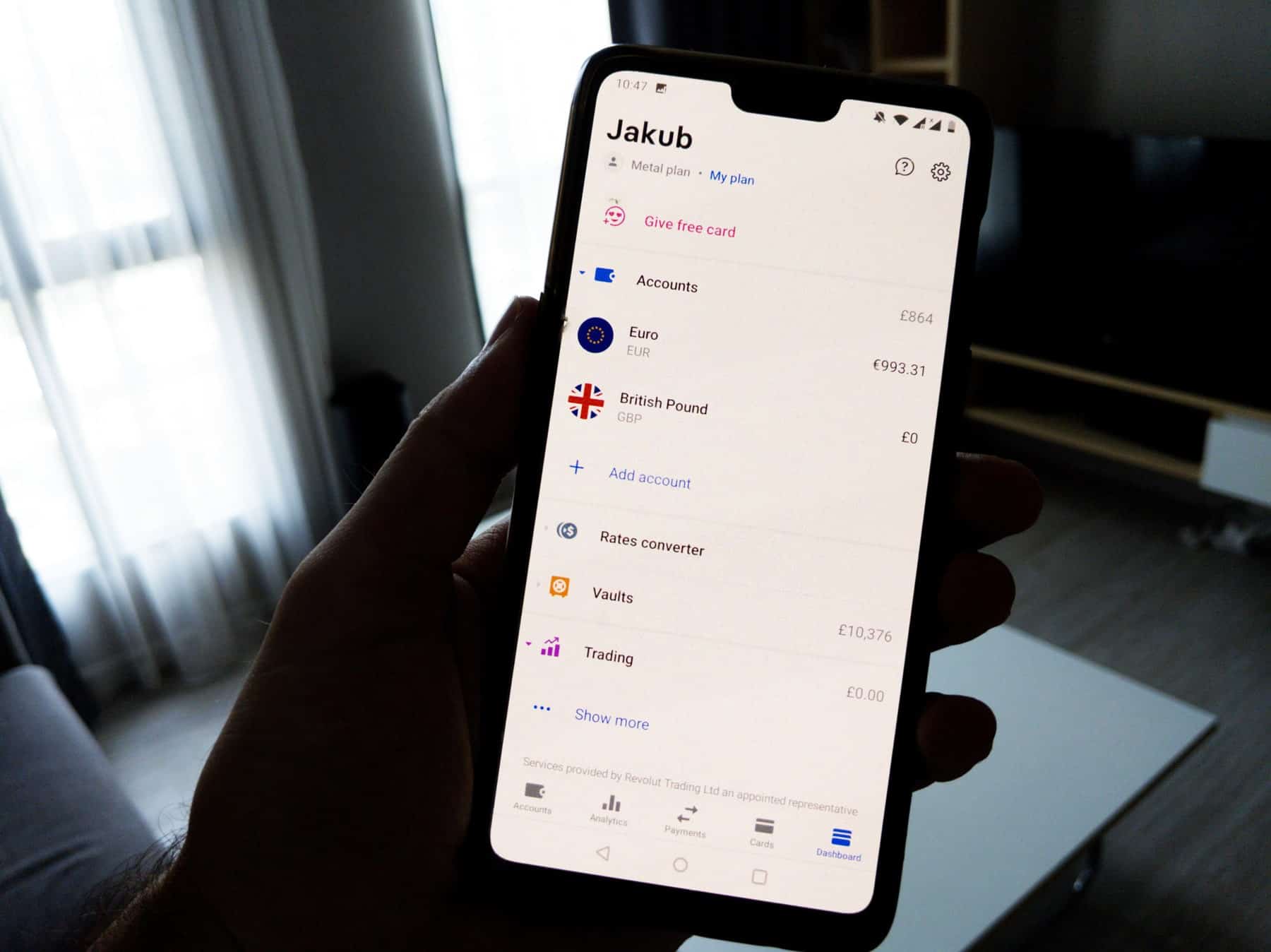

Revolut Metal isn’t only a debit card but the most user-friendly personal finance app I have ever used.

My Revolut Metal Experience

In this Revolut Metal review, I want to cover my personal experience with Revolut Metal as well as with the entire ecosystem that comes with it.

My experiences and opinions are based on how I used the card over the last 36 months.

Best Exchange Rates and Multicurrency Management

Revolut offers currently the cheapest way to pay for your expenses abroad or in different currencies. Most of my funds are stored in my EUR account. Over the course of the last few months, I traveled to Morocco, Philippines, Sri Lanka, Thailand, and many European countries.

Apart from a small hiccup in Morocco, I have not had any issues with my Revolut Metal card. It turned out that my issues in Morocco were related to the ATM rather than the card itself.

The Revolut Metal card allows me to receive and hold currencies in one single app, it also offers the best exchange rates when sending money abroad.

If I have to make personal bank transfers in different currencies, I always use Revolut. The cost of the transfer was always cheaper as compared to TransferWise which comes with a TransferWise fee.

Foreign Currency Exchange Fees

Regardless of what type of Revolut plan you are using, Revolut charges a mark-up between 0.5% and 1% during your currency exchange on the weekend.

Here is an overview of the currency exchange fees.

- USD, GBP, EUR, AUD, CAD, NZD, CHF, JPY, SEK, HKD, NOK, SGD, DKK, PLN, and MXN: 0% during fx hours (weekdays), 0.5% when the markets are closed (weekend)

- THB, RUB, UAH: 1% during fx hours (weekdays), 2% when the markets are closed (weekend)

- all other foreign currencies: 0% during fx hours (weekdays), 1% when the markets are closed (weekend)

This is something most users aren’t aware of and the information is also not as easy to find. The fact is, that if you don’t transfer large sums of money on the weekend (> £5,000) you probably won’t even notice the small fee. Last year when I was on a trip to Iceland, I run a small experiment and paid my expenses on the weekend with the N26 You (Premium) and Revolut Metal card. The difference was less than 10 cents, which is zero to nothing.

Online Purchases

If you are thinking about getting the Revolut Metal plan, you will likely use the card or the virtual cards to make online purchases. In most cases, you will need to verify the transactions in our Revolut app.

You might be wondering, why I am mentioning this, as the two-factor verification is nothing new.

Well, it’s something that should not be taken for granted.

While Revolut’s two-factor verification for online purchases works like a charm, the N26 feature has tons of bugs and it’s almost impossible to make online purchases – at least that’s the case with my N26 card.

A great feature of Revolut is also Revolut’s disposable virtual card. Note that those cards might not get accepted by every merchant, however, in most cases they work well and it helps to protect your Revolut Metal card information as you don’t need it when shopping around on the internet. You can access the virtual card through your Revolut App.

Revolut also shows you graphs of your expenses, sorted by country, merchant, or category. A really nice feature if you ask me.

Join Revolut

Revolut Volts and other Features

As a Revolut user, you can create volts that help you set money aside. It’s a simple feature that will put your money in a “vault” so the balance won’t appear in your regular account that you use for daily expenses.

Revolut’s volts do not lock your funds. You can access them at any time. There is also no interest on your funds in your vaults. The sole purpose is to save up some money aside. You can either tell Revolut to transfer each month a certain amount to your vaults or do a one-time transfer. An interesting option is also to let Revolut round up your expenses and add the spare cash to your vault.

I have been using this feature quite a lot and it really helps to maintain an emergency fund or reach my financial goals.

Revolut also supports Google Pay or Apple Pay so you don’t even need to carry the card with you if you prefer to do so.

Apart from vaults, you also have access to airport lounges. This feature is quite useless in my opinion. Access to almost any lounge costs around £25 per person. You can buy the access at any lounge, so booking it via Revolut doesn’t provide much value.

Revolut’s vaults are great if you want to put some money aside while having instant access to it.

Revolut Metal Cashback

You can earn up to 1% cashback by using the Revolut Metal card. Metal plan users will receive 0.1% cashback on all card payments within Europe and 1% cashback on card transactions outside of Europe.

In order to use the cashback to cover your Revolut Metal monthly subscription, you would need to spend at least £971 per month outside of Europe.

For most users, this isn’t feasible and I made only around £40 cashback since I joined the Revolut Metal plan. It helps to cover for some of the fees, however, I feel like this shouldn’t really by the metric to compare.

The cashback you will receive with the Revolut Metal card is simply a nice add-on but not a comparison criterion.

Revolut Metal Insurance Review

Many users consider ordering the Revolut Metal card for its insurance. Let me tell you this. If you are an occasional traveler with short trips under 40 days, Revolut offers very basic travel insurance that might lower the cost during emergencies.

Note, that you should cover all your expenses for your trip with the Revolut Metal card to claim the insurance refund in case things go sidewards. Also if you choose to submit an insurance claim, you will have to pay £75 access.

Revolut’s Insurance Covers:

- Emergency medical assistance, evacuation and repatriation up to £15,000,000

- Emergency dental treatment when abroad up to £300

- Access to an extensive network of medical centers

- Delayed baggage insurance after four hours up to £320

- Delayed travel insurance after for hours up to £320

- Travel and accommodation costs if treatment delays your return

As you can see, Revolut’s insurance isn’t sufficient and I would absolutely not rely on it. If you are traveling on vacation or have a world trip in mind, I suggest looking into the travel insurance from SafetyWings. Their terms are flexible and you can apply for insurance even if you have already left your home country.

Revolut Plastic vs Metal Card

Some users like to see a comparison between the standard card and the Revolut Metal.

Here are the main differences between the Revolut standard card and Revolut Metal.

Revolut Standard:

- No-fee ATM withdrawals only up to £200 per month (afterward 2% fee)

- Currency exchange limits up to £5,000 per month at no extra cost (apart from the weekends)

- No insurance

- No priority support (it can take a few hours to get a reply from Revolut)

- No virtual cards

- No junior accounts

- Standard design

- No cashback

Revolut Premium vs Metal

To summarize, here are the main differences to the Revolut Premium card, which costs £6.99 per month.

Revolut Premium:

- No-fee ATM withdrawals only up to £400 per month (afterward 2% fee)

- No cashback

- No concierge service (I have never used this feature)

- No metallic design

Revolut’s Support

I have criticized the support of digital banks quite a lot in recent years. Revolut was no exception. It is, however, good to see how it evolved over the past few months.

You can certainly feel the difference between the support you get as a standard card user compared to the support that comes with the Revolut Metal card. Troubleshooting is much more efficient now.

Recently we had to leave the Philippines by emergency due to the upcoming lockdown that was put on Manila. We had to change our travel plans and I booked our flights last minute on our way to the airport.

The internet connection was quite bad, and the Philippine Airlines charged me twice for the same flight. I requested a refund from the airline; however, even after five weeks, the airline wasn’t able to handle it so I tried tackling this issue via Revolut with a charge-back application.

Revolut proposed a quick solution and the charge-back was accepted. Now I am waiting to get my £500 back. I will share the outcome with you as soon as this is resolved. Revolut said it can take up to 45 days.

Even though this case isn’t closed yet, the experience with Revolut’s support was positive.

Revolut Metal Card Price

The Revolut Metal card costs £12.99 per month. You can pay month by month or once a year. If you pay upfront for 12 months, you will get a £39.88 discount on your Revolut Metal plan.

With the annual plan, it’s only £9.66 per month – the price of three coffee cups.

Try Revolut Now

Note that currently, the Revolut Metal card isn’t available for users from the US and Canada. If you come from North America, consider the Revolut Premium card for $9,99 instead. In case Revolut rolls out the Revolut Metal card for U.S. users, I will update my Revolut Metal card review.

Is the Revolut Metal card worth your money?

Whether the Revolut Metal card is worth, it depends on your individual needs. If you travel a lot while not using much cash, the Revolut Metal plan might be worth the money.

I use the card mainly for online payments or card payments in grocery stores and coffee places.

What I really appreciate about Revolut Metal is the whole ecosystem that simply works. I can literally send money to anyone in less than two minutes which saves me so much time compared to any action with traditional banks, where only log in to your account takes at least five minutes.

If you use one of the traditional banks, chances are that they charge you enormous fees while providing little to no value. Their banking products cannot match the user-friendliness of Revolut’s banking app which is why Revolut is the fastest growing digital bank in the world.

If you have any trouble with your bank, you can reach Revolut’s customer support within one minute – who else gives you this speed?

Using the Revolut Metal card is time-saving, affordable, and user-friendly which is why Revolut Metal became my card of choice.

Do you also want to save time and money?

❓ How to get the Revolut Metal?

First, you need to download the Revolut app. After you register you can upgrade to the Revolut Metal plan. Tap on More in the right-bottom corner and go to Upgrade. You can now choose the Metal plan and read more about the features. As you click on Continue you can choose the annual or monthly plan and read their Terms and Conditions.

❓ Does Revolut Metal cost money?

The Revolut Metal card is not for free. You can sign up with the monthly plan and pay monthly with the option to cancel your membership every month for an early termination fee of £26 / €30. If you sign up with the annual plan you will receive a 14% discount but you cannot cancel anytime.

❓ How much does Revolut Metal cost?

The Revolut Metal card costs €13.99 / £12.99 per month if you sign up for the monthly plan. In case you decide to pay upfront for the whole year, the annual plan comes with a 14% discount and costs €135 / £116. The monthly plan gives you the option to cancel before the end of the 12 months period.

❓ Is Revolut Metal card worth the money?

Absolutely. The Revolut Metal plan provides you with the most efficient banking experience in 2020. Learn more about it in my comprehensive Revolut Metal review.

Hey mate! I wanted to pay the fee for metalic card and after the card is sent just stop paying the subscription.. Will the card still work or would i need to still pay it in order to use it? Thanks

Hey Alexandru,

basically it’s a one-year subscription 12.99 / month. I think there is a discount if you choose to pay for everything upfront. I am quite sure that they would block your card if you don’t pay the subscription fee. Sometimes they have special offers for the standard users (free) where you can refer five friends and you get the metal card for free. I suggest you keep an eye out for similar promotions if you don’t feel like paying for it.

Cheers

How much money can I have inside my revolut account

I am not aware of any limits when it comes to the amount of money you can store. There are some transfer limits of several thousands euro. Depends also on the type of account you have.

Apart from the minimal cashback and concierge service I see no reason for opting for the Metal over the premium account, might just be me. Revolut have just today told me that they will reduce the free monthly exchange limit for basic accounts from 50 000 SEK to 10.000 SEK (I am in Sweden). Not sure if this is happening for other EU countries also but just a heads up y’all.

Fair enough David. I use the card 90% of the time outside of Europe which gives me 1% cashback – I use it enough to cover the annual fee so it makes sense to me. Concierge service I have never used myself. There are some more perks like better conditions for crypto / stock trading now (not sure exactly as I don’t use it atm)

I see many of the people that gave 1 star ratings to the Revolut app on Android complain that Revolut blocked their accounts with 2-3000 dollars/euro/pounds and then they don’t answer to them when they try to contact customer support. There was a famous case of a reporter who got his account blocked and Revolut just ran away with his money. What stops them from doing the same thing to me once they decide I filled my account with money?

I also read that the customer support doesn’t actually exist, if you have an issue you’re on your own. Sometimes in the middle of nowhere. Just read this thread, I mean there’s people complaining 16h ago:

https://community.revolut.com/t/how-can-i-speak-to-a-person-for-help/12541/52

Yes, there are some rumors. I can only speak from my own experience. So far I haven’t had any issues and I was always able to get in touch with the support via the App.

Hi! Thanks for an interesting review. I have the standard Revolut at the moment, but thinking of getting the premium or the metal plan instead.

One thing I have a hard getting clarity in is the following:

“all card payments within Europe and 1% cashback on card transactions outside of Europe. ”

Does Europe refere to the EU/EES-area or does it refer to the geographical Europe as a whole? This matters a lot to me as I normally spend a lot of time in Ukraine, Russia and Serbia in my job. Any idea?

Hi Erik, here’s your answer: https://nimb.ws/zXjhZp

Can I also get cashback on my virtual disposable cards?

Not sure, for this you are better off contacting the support directly.

So I just signed up but was never given the choice of card colour on the metal plan, am I right in assuming the more yours you roll over the higher up the tier you go? If so Is the first metal card black?

not sure what you mean, I got mine like a year ago so I am not aware of the current setup. I have the golden metal card.

Seems far more likely, you just wont receive the added benefits, then them blocking your card. After all the card is just that, everything is attached to your account.

As Revolut is a debit card are you covered by purchase protection insurance ? Just before I upgrade to a metal card

Not sure about this, I think this insurance has been removed in the past few weeks. You would have to check with the current terms and conditions before signing up.

Hello I have upgraded to premium for less than a month and I would like to switch to metal.

Do you know how much is the cost?

Best regards,

Chris

The best answer you will get is by directly contacting Revolut.