How to Leverage Peer-to-Peer Lending

Anyone who has ever invested in P2P loans got at least once the idea to leverage its P2P portfolio. I must admit, this idea came across my mind several times as well.

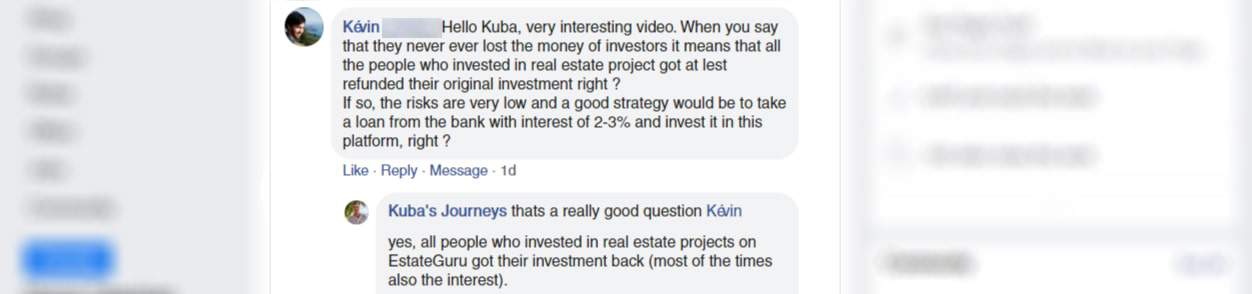

Recently a friend asked me the same question on facebook.

As there is no simple answer to this I decided to create a blog post where I will be sharing my thoughts on leveraging a P2P portfolio.

I will also talk about what I believe is important to think about before taking the step to lend money to invest on P2P platforms.

Note that this post is for advanced investors, who already have some experience with P2P lending.

Reasons to leverage your Peer-to-Peer portfolio

If you have invested in a few P2P lending platforms and you have never lost any money, taking an inexpensive loan to increase your portfolio size and therefore your returns might sound like a good idea.

P2P lending platforms that I use myself generate me at the end of the year more than 10% of interest on my investments.

In theory, the higher my investment, the higher the returns right?

Good reviews, amazing past performance, good financial reports, “secured” investments and promising plans for the future are other reasons why someone would lean towards levering their P2P portfolio with certain P2P platforms.

Do your calculations

When does it pay off to leverage your P2P portfolio? What are the metrics that you need to be looking at?

First, let’s look at the net interest earned from Peer-to-Peer lending. Net interest means interest payments deducted by the tax. Depending on your country’s regulations you need to pay up to 50% tax (depending on your tax status) on your income from Peer-to-Peer lending.

Let’s assume you have invested €10.000 and earned 12% interest per year. After taxes, your net interest is 10% (in case you would need to pay 20% on your earned P2P income).

Investment: €10.000

Net income from P2P: €1.000

You talk to the bank which can offer you a loan at the free disposal, meaning the bank won’t ask you what you will use the money for.

Depending on your country of residence, your income and monthly expenses you might get a loan offer with an annual interest between 3% to 8% (most likely).

Let’s say these are the loan conditions.

Loan amount: €10.000

Interest: 5% per year (p.a.)

Loan period: 12 months

The monthly payment is €856 (amortization and interest). In total, you will pay back €10.272 (€10.000 amortization, €272 interest).

If you invest this money for the expected annual net return of €1.000 it’s clear that after you have deducted the interest for your loan, you make a win of €728.

Let’s say one of the variables (interest) changes. Here is the change in your returns from leveraging your P2P portfolio.

| Interest on your loan | Returns from leveraging your P2P portfolio |

|---|---|

| 3% | €837 |

| 4% | €783 |

| 5% | €728 |

| 6% | €673 |

| 7% | €617 |

| 8% | €562 |

You can use various online loan calculators to make the calculations. You can also change the loan period as well as the loan amount. Just deduct the interest from the expected P2P returns.

At first sight, this seems like a no-brainer. There are however more things that you should consider when thinking about leveraging your P2P portfolio.

Can you get a loan?

The first thing to sort out before spending too many thoughts on how you could leverage your P2P investments is to find out whether you will get a loan. Even within Europe, the loan terms vary depending on where you reside, your income and overall financial situations.

Don’t get lured into ads, promising cheap loans. Until the bank checks your credit score and your financial background you don’t know how much interest you will need to pay.

Are there any additional P2P lending platform fees?

I only invest on P2P platforms, where I don’t need to pay any fees as an investor. All the overhead costs are financed by the cut that the P2P lending platform takes from the borrowers or loan originators that list their loans on the platform.

There are however P2P platforms that charge you for investing or withdrawing your funds. Just have this in mind as you want to choose a platform that is ideally free for investors.

Here is a comparison of European P2P lending sites, that I use myself.

Do I have to pay some additional bank fees?

The loan interest can vary depending on the loan amount and the loan period. Additionally, the bank might charge hidden fees that aren’t obvious at first sight. I would explicitly ask the bank whether there are any other fees.

You also want to make sure that you can pay back the loan before the end of the loan period for free.

Will I be able to make the monthly payments?

The bank will require you to pay back the loan in monthly installments. Meaning you will need to pay back the amortization as well as the interest every month.

The question you need to ask yourself is whether you are able to cover this from the incoming P2P income or whether you need to pay it from your main source of income.

This depends on the loan types you are investing in.

Some platforms, such as EstateGuru, that allows investors to invest into secured real estate projects, lists only “bullet” or “full bullet” loans, meaning the full loan amount will be repaid at the end of the loan period. In this case, you could not use the P2P income to pay back the loan.

Other platforms, such as Mintos or Peerberry pay back the investment as well as the interest on a monthly basis, meaning you could, in theory, use this to pay back your loan.

There is however one issue with this as well and I will talk about this later.

Is this aligned with your investment strategy?

Whether leveraging your P2P portfolio is a good idea also depends on your investment strategy. Let’s say you are in mid-twenties and are thinking of taking a loan of €30.000 to leverage your P2P investments, which is considered as a high-risk investment.

Think further into the future, what are your goals within the next five years? Do you want to invest in properties yourself? In that case, you would need some cash to pay the deposit and get a mortgage. Taking a loan for speculative purposes would probably not help you to achieve this goal.

Past performance does not predict future outcomes

Many P2P platforms offer buyback guarantees for investor’s investment, meaning that if the borrower is late with its payments, the loan originator will buy it back for you and you won’t lose. This has worked out well for me and indeed I never had any loss from my P2P investments.

Other platforms don’t work with loan originators but directly with borrowers such as companies, who put some collateral on the line to secure their loans. Even though a platform claims that it never lost investor’s money it doesn’t mean this cannot happen in the future.

There are many things that you as an investor as well as the P2P lending platform can’t always influence.

External factors you should consider when leveraging your P2P portfolio

Regulations

Many European countries start to put regulations in place to control the operations of P2P lending platforms. While generally regulations are not evil, you cannot predict what kind of influence it can have on your portfolio.

We can extend this thought on regulations on the companies you have helped finance with your money. Average investors are usually not aware of new laws that can have a significant impact on the ability of the borrower to pay back their loan.

Recessions

The risk that the borrowers won’t pay back the loan is in a booming economy much lower than during a recession. Your portfolio value can drop during a recession as well. If your portfolio consists mainly of unsecured personal loans, you should expect some defaults.

Even property-backed loans can lose in value. Small markets like in the Baltics react very fast. There is a chance that the value of the property drops by 50% and suddenly your investment isn’t fully covered anymore. To learn more about this topic, I suggest reading my article about how safe is P2P lending.

Late payments from the borrower

Every P2P investor knows that there are many borrowers that don’t pay on time. Regardless if you invest on Mintos in personal loans or on EstateGuru in real estate loans. There will always be those borrowers who pay later.

If you rely on regular payments to pay back your own loan, this might cause some issues.

Early payments from the borrower

Even though it isn’t obvious to many P2P investors, some borrowers pay back earlier than anticipated. This means that you won’t get the full expected interest from your investment.

You will need to figure out how to reinvest your money so you can generate enough income to pay back your loan.

Loan originator goes bankrupt

It’s not very common but sometimes loan originators (loan companies that list their customer’s loans on a platform) might go out of business. Retrieving investor’s money from those companies isn’t a simple and fast process. It can take months and often it’s uncertain how much investors will get back.

How is your investment secured

Every investor should be aware of the securities and guarantees that come with each investment. P2P-investors particularly should be aware that they can lose all their money.

Most P2P lending platforms allow investors to invest into unsecured debt. This investment isn’t backed by anything and you need to trust the platform as well as the loan company to retrieve your money back. Sometimes you might get dissapointed.

You also have the option to invest into secured real estate projects, but again you should be looking into the loan types (bullet and full bullet) as well as the loan period. This kind of investment isn’t great for people who aim to leverage their portfolio while paying back their loan in monthly installments.

What’s your diversification ratio?

When leveraging your P2P investments you should lower the risk of default as much as you can. You can only achieve this by diversifying your investments. A proper diversification in various loan types, countries and platforms that fits your loan period might take some time.

Leveraging already leveraged projects

When taking a loan to invest into P2P loans you are leveraging already leveraged projects. It’s no secret that the more leverage you have, the riskier it gets. Just have a look at CFD trading, where 95% of the people lose money. In P2P lending, you invest money in loans where the loan company itself only invests 5% to 10% of their own funds.

Taking a loan to invest in a loan is extremely risky. You are not only risking the money you have but also the amount you don’t have. This might end up very bad. It’s impossible to evaluate the outcome as you can’t calculate the risk due to external factors that you can’t control.