Revolut Metal Review - Is The Revolut Metal Card Worth It?

With the Revolut Metal plan, you can benefit from complimentary travel insurance, a fancy metal card, commission-free trading, discounts for international transfers, and higher no-fee ATM withdrawal limits. You can access all those Revolut Metal benefits for only £12.99 per month or buy the annual plan at a 20% discount.

If you reside in the U.S. we suggest reading our Revolut Metal Review USA, which covers the terms as well as the pros and cons for U.S. clients.

In this Revolut Metal review, we will dive deeper into the terms and conditions so you can determine whether the Revolut Metal card is worth the money.

| Feature | Metal Plan |

|---|---|

| 🏷️ Monthly Price | £12.99 |

| 🏧 No-Fee ATM withdrawals | £800/m |

| 🌐 No-Fee payments abroad | Yes |

| 💳 No-Fee card delivery | Yes |

| 💬 24/7 Priority Support | Yes |

| ✈️ Travel Insurance | Yes |

| 🎁 Cashback | Yes |

Revolut Metal Benefits & Disadvantages

Revolut Metal has many benefits that might be of great value to you. There are, however, also a few disadvantages that you might encounter when using the Revolut Metal card.

Revolut Metal Benefits

- Up to £800 no-fee ATM withdrawals worldwide / month

- No-Fee express metal card delivery

- No currency exchange fees for amounts above £1,000 / month

- 0.1% cashback in the EU, 1% cashback outside of the EU

- 40% discount on international transfers

- Travel Insurance

- Access to discounted lounge passes

- Priority 24/7 chat support via Revolut App

- Lower trading fees, including 10 commission-free trades every month

- Up to 2.76% interest

Revolut Metal Disadvantages

- 2% ATM withdrawal fee for monthly withdrawals of more than £800

- £35 card issuance fee and delivery fee if you lose your Revolut card abroad

- Only available with a paid plan

Remember that Revolut Metal comes with all the perks offered by the no-fee and inferior paid plans. You can pay with your debit card worldwide, exchange money at the best rates, and use multi-currency accounts, virtual cards, and instant SEPA transfers.

Revolut Metal elevates those features by giving you additional benefits that help you save money, especially when using Revolut abroad.

We have been using Revolut Metal for the past three years, so this review is enhanced with our own experience with Revolut and the Metal card.

Revolut Metal Fees

Revolut Metal card costs £12.99 per month. By subscribing to the Revolut Metal annual plan, you will save 20% on the monthly price. While Revolut Metal offers many services free of charge, there are a few fees that you should be aware of.

| Feature | Metal Plan |

|---|---|

| Monthly Price | £12.99 |

| Card delivery | No-Fee |

| Replacement card | £35 / €39.99 + delivery fee |

| ATM withdrawals | 2% above £800/month |

| Crypto exchange fee | 1.49% |

| Commodity trading fee | 0.5% |

| FX fees | No-Fee from Monday to Friday |

Note that Revolut offers an attractive cashback bonus, which will help you to pay back your subscription fee, especially if you live abroad or use Revolut during your travels.

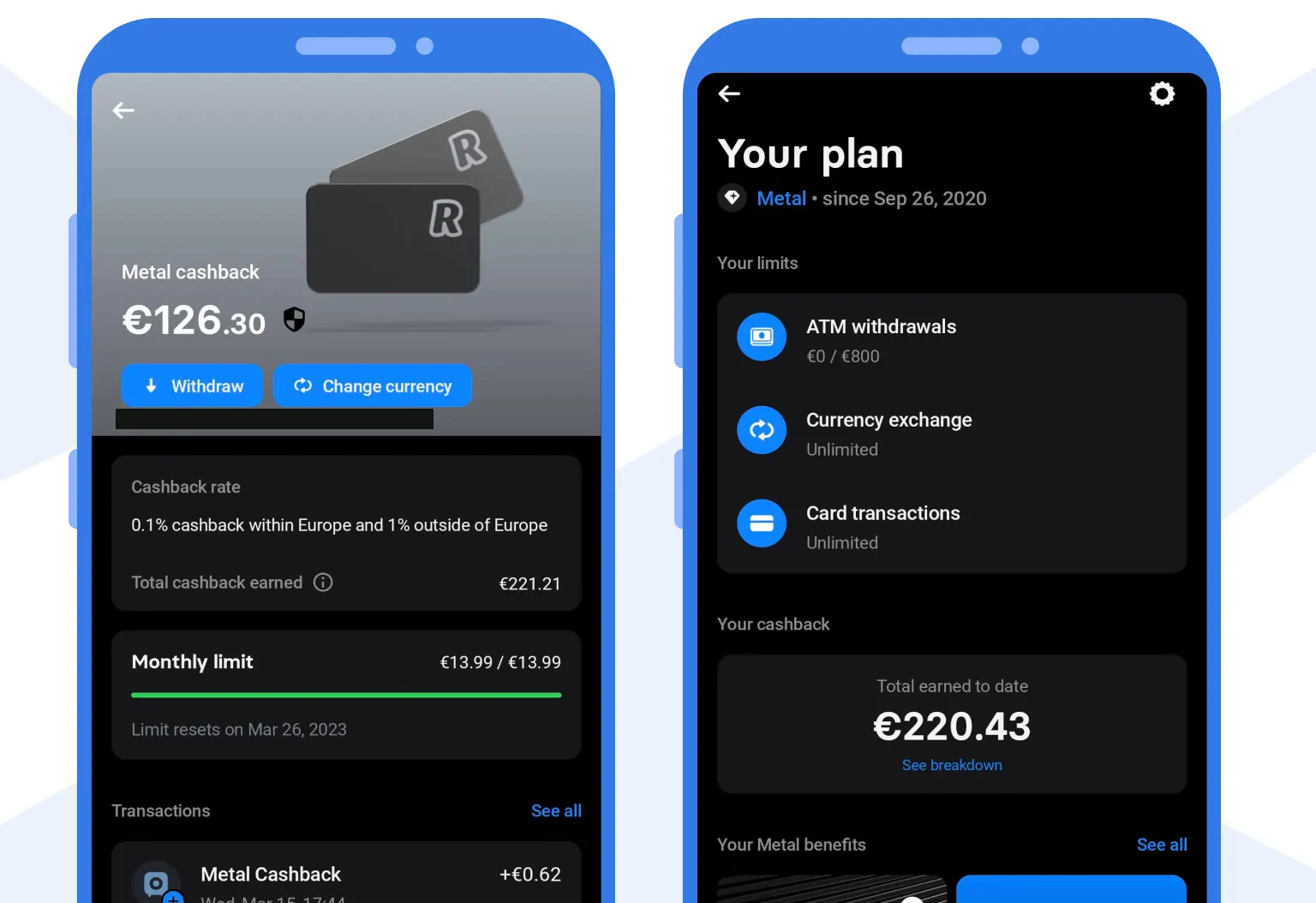

Revolut Metal Cashback

The Revolut Metal plan offers a premium metal card and 0.1% cashback on all transactions within Europe and 1% cashback outside of Europe.

If you decide to use Revolut abroad, chances are that you will be able to pay off your the Revolut Metal subscription fee with your cashback bonus.

The monthly cashback amount is limited to the monthly subscription fee. If you decide to purchase the annual plan, you cannot only pay back the subscription fee by using Revolut outside of Europe but also earn some additional profit from your Revolut cashback bonus, since you can purchase the annual plan and save 20%.

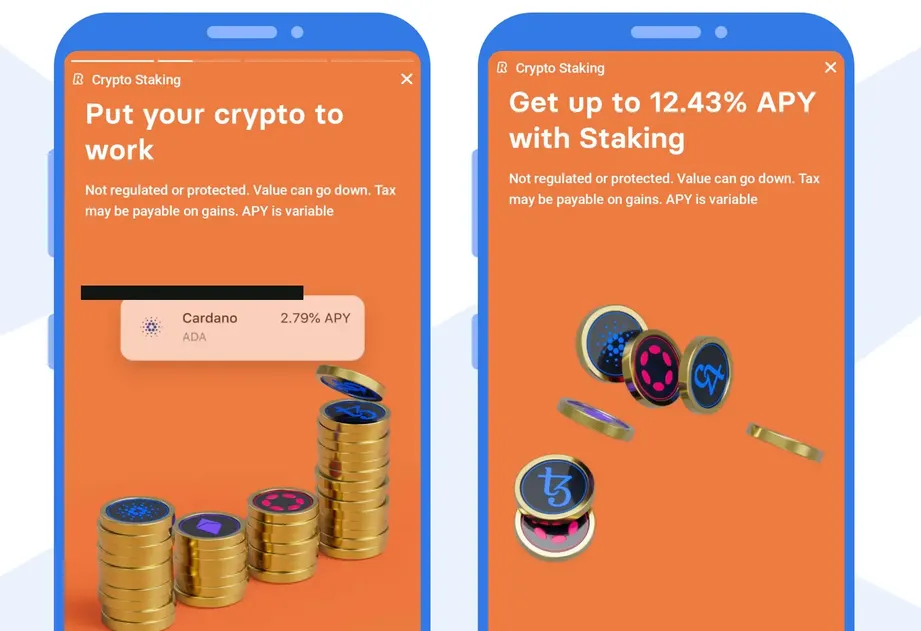

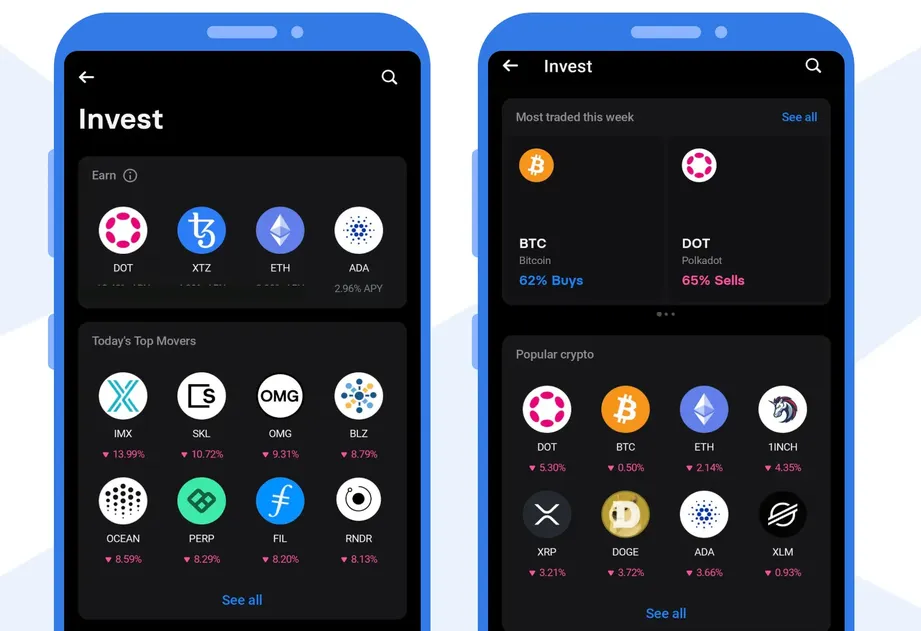

Revolut Metal Crypto

If you are interested in buying crypto as a Revolut Metal plan user, you will be charged a 1.49% crypto exchange fee. Revolut Standard and Plus users must pay 1.99% or a minimum of £0.99 per trade.

By using Revolut Metal you will save on trading and crypto exchange fees.

Revolut offers the option to purchase and hold 98 cryptocurrencies and stake 4 coins, Polkadot, Tezos, Ether, and Cardano. By buying and staking crypto, you can earn up to 12.43% with Revolut. The rewards are paid weekly and can be restaked automatically.

If you decide to unstake your crypto, your assets will remain locked for 29 days before you can sell them.

Your crypto tokens on Revolut will be deployed in proof-of-stake blockchains to generate rewards.

While you shouldn't expect complex crypto trading features, Revolut offers a beginner-friendly crypto exchange that can be used, especially if you are starting out with crypto and don't want to investigate crypto exchanges and deal with crypto wallets.

With Revolut's crypto feature, you can buy and sell crypto anytime via the Revolut app.

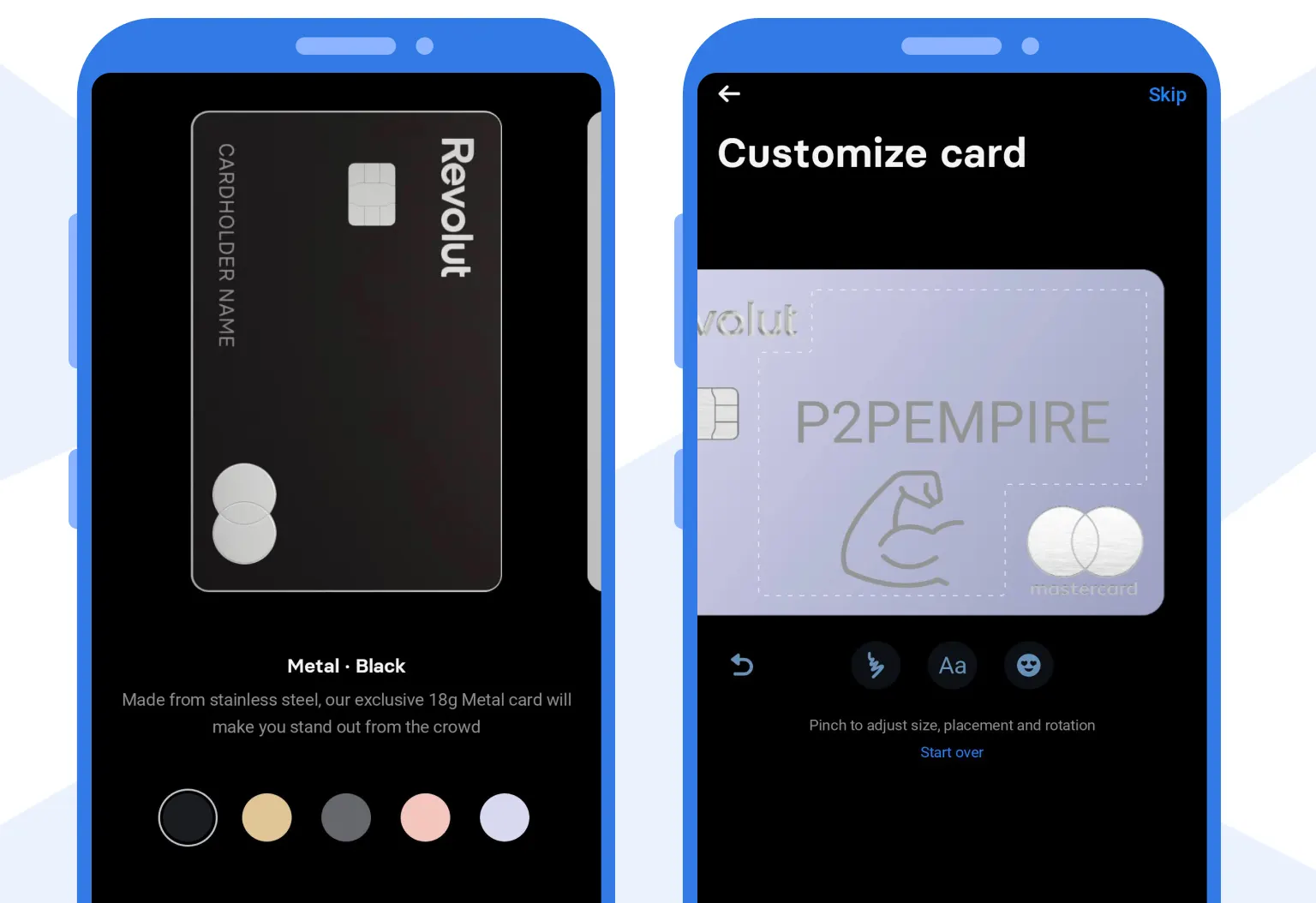

Revolut Metal Card

The Revolut Metal card is one of the best-looking metal debit cards you can get. The 18-gram card, made from stainless steel, will make you stand out when paying in shops.

The Revolut Metal card lets you pay for goods and services worldwide and withdraw cash from any ATM globally. As mentioned, you can withdraw up to £800 (or equivalent) monthly without paying any fees.

You must pay a 2% withdrawal fee to withdraw more cash. For users who live in a cash-friendly country, we recommend using the N26 Premium or Metal card, as you can make no-fee ATM withdrawals without any limits.

Revolut Metal Card Design

The Revolut Metal card comes in five unique designs that you can choose from.

- Metal - Black

- Metal - Gold

- Metal - Space Gray

- Metal - Rose Gold

- Metal - Lavender

If you are a Revolut Metal user, you can customize your Metal card during ordering.

We have been using the Revolut Metal card for quite some time, so we recommend picking a lighter color, such as Gold, Space Gray, or Lavender.

The finish on the stainless steel card tends to chip away after a few months, meaning if you order the Revolut black card, it might lose the "premium look" after a while as the black finish chips away.

Is the Revolut Metal card too expensive for you? Check out our Revolut Premium review to find out how you can get most of the benefits from Revolut Metal for the first three months.

How To Apply For A Revolut Metal Card?

Applying for a Revolut Metal card is simple. First, you must register your phone number and download the revolut app.

After you have downloaded the Revolut app, you have to follow these steps:

- Sign up for a Revolut account

- Pass the KYC process

- Top up your account

- Go to "Hub" and click on your plan on the upper right corner

- Click on the name of the plan in the left corner

- Review the plan and change it to Metal (if you haven't done it yet)

- Go to "Cards" in your Revolut app

- Choose a physical card

- Order your Metal Card

The first Revolut Metal card offers express shipping. You can expect to receive it at your address within three business days. If you lose your Revolut Metal card, you can order a new one, but it will cost you £35 / €39.99.

If you are interested in applying for the Revolut Metal card, we recommend getting the annual plan as you will save around 20% compared to paying a monthly subscription fee.

Revolut Metal Card Insurance

The Revolut Metal plan comes with additional features that can be useful for frequent travelers and users keen to explore some of the investment features Revolut provides.

Revolut Metal card comes with the following perks:

- Purchase Protection - If your phone, tablet, or other eligible item is stolen or accidentally damaged, Revolut will reimburse you to €10,000/year for up to 365 days after the purchase.

- Refund Protection - Revolut will refund up to €300 on your eligible purchases for up to 90 days since the purchase.

- Event Ticket Protection - Revolut will refund your ticket price up to €1,000 / year if you can't attend an event.

- Unlimited FX - Revolut won't charge you any exchange fees from Monday to Friday for 29+ currencies.

- International Travel Insurance - Revolut's insurance partner will cover medical treatments up to €10M with a €50 excess fee for trips of a maximum of 90 days.

- Winter Sport Coverage - Revolut's insurance partner will cover injuries and lost, stolen or damaged sports equipment.

- Car-Hire Excess - Revolut's insurance partner will cover up to €2,000 of the specified excess, deductible or damage liability fee.

- Personal Liability - Revolut's insurance partner will cover claims of up to €1M payable to a third party for damage or injury caused by you.

- SmartDelay - You will get a fee lounge pass for you and 3 friends if your flight is delayed for over an hour.

- Reduced Rates For Crypto & Commodities - With the Revolut Metal plan you can enjoy low crypto exchange fees of 1.49% and reduced exchange fees of 0.5% when trading commodities.

Are you wondering how Revolut compares to the competition? Check out our guide Revolut vs Wise.

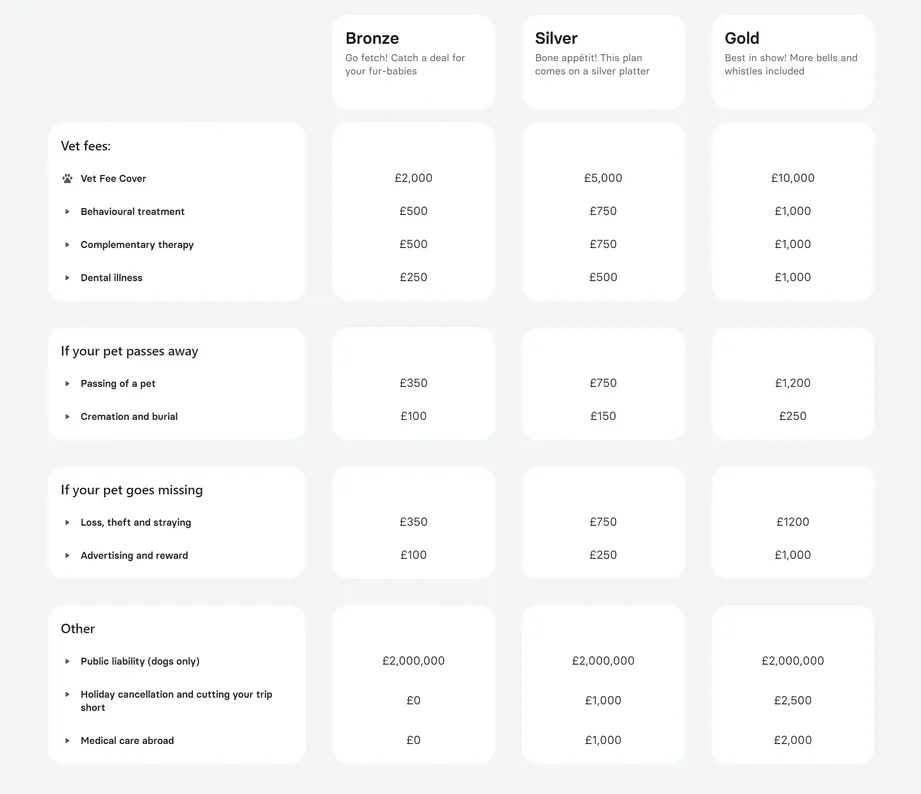

Revolut Pet Insurance

If you are a user from England, you can also enjoy Revolut's pet insurance. You can explore Revolut's insurance coverage in your Revolut "Hub".

Revolut offers the following insurance package for pets:

- 24/7 online vet support

- Medical care abroad

- Financial compensation when your pet passes away

- Financial compensation when your pet goes missing

In your Revolut app, you can set up an insurance profile for your furry friends. Revolut's insurance partner offers three different pet insurance plans. Here is an overview of the offered insurance plans.

It's worth mentioning that the insurance price varies depending on the breed and age of your pet. You will need to request a quote directly in your Revolut app to access pricing. Generally speaking, the monthly price for Revolut's pet insurance ranges from £8 to £31 per month, depending on the plan.

Revolut Pet insurance is currently limited to specific locations.

Is Revolut Metal Worth It?

Whether the Revolut Metal card is worth, it depends on your needs and the Revolut Metal plan features in your country.

If you are considering ordering a Revolut Metal card in the U.S., we suggest reading our Revolut Metal review for U.S. clients.

If you appreciate modern and safe banking apps with user-friendly financial products, Revolut is undoubtedly one of the best options on the market.

As a frequent traveler, you will benefit from the higher no-fee ATM withdrawals and the complimentary travel insurance.

If you aren't traveling a lot, transferring money abroad, or comfortable using your phone to manage your money, Revolut might not be the best fit for you.

We have been using the Revolut Metal plan for years, and honestly, we can't imagine returning to the Standard plan.

The 24/7 priority support alone makes the Revolut Metal plan worth it. You never know when you will need to use it, but when you do, it's great compared to the support of other digital banks.

Revolut is one of the few (if not the only digital bank) that can send a replacement card abroad or refund your money from bookings you couldn't attend.

If you are an active user of Revolut outside of Europe, you can likely pay off the Revolut Metal subscription fee with the 1% cashback. This means that you can essentially use the Revolut Metal plan at no additional costs.

Are you ready to apply for the Revolut Metal card?

Or learn how the Revolut Metal plan compares to other Revolut plans in our comprehensive Revolut review or learn how to get money on Revolut.