Wise Card Review 2023

The Wise Debit Card is an established player in the world of debit cards. It has some great features and benefits that make it worth considering if you are in the market for a new debit card.

In this review, we will take an in-depth look at the Wise Debit Card, its features, costs, benefits, and disadvantages so you can decide whether it is worth it.

What Is The Wise Card?

Wise Card is a physical card issued by Visa and offered by Wise (formerly Transferwise).

The Wise Card is connected to your personal or business account at Wise, a licensed payment provider, enabling you to easily store, receive and send money in multiple currencies for the lowest fees.

The Wise Debit Card lets you pay safely online or in your local supermarket. Wise also supports Apple Pay and Google Pay giving you even more options to pay for goods and services worldwide at the lowest cost.

Wise Card in a Nutshell

- UK, US, EU bank accounts

- Multi-currency account and exchange feature

- Pay safely anywhere

- Low fees

Ready to save money with Wise?

Wise Pros And Cons

As with any debit card, there are always pros and cons that you should consider before registering. Let's have a look at the pros and cons of the Wise Debiut Card.

Pros of the Wise Card

- Lowest multi-currency transfers

- Very user-friendly banking app on Desktop and Mobile

- FCA regulated

- Over 15 million customers

- Available worldwide

- Best for travelers and freelancers

Cons of the Wise Card

- Fees for ATM withdrawals of more than €200 per month

Who Is The Wise Card Suitable For?

The Wise debit card is suitable for sending and receiving money in multiple currencies. You can store your funds in up to 49 currencies.

Even if you decide not to use the multi-currency feature, Wise is famous among travelers mainly due to the best exchange rates when paying with the card in foreign currencies.

The Wise account enables you to get a EURO IBAN, a UK account number, or a US routing number, which is fantastic if you are a freelancer with clients from various continents.

The Wise Card is also suitable for investors who wish to invest on European P2P lending platforms, as it provides an IBAN required by most platforms.

Who Can Apply For A Wise Card?

Almost anyone living in Europe, Canada, the USA, Australia, or New Zealand can apply to get a Wise debit card. Wise is also available for users in Brazil, Singapore, Malaysia, and Japan.

How to deposit cash on Wise?

Depositing cash on your Wise account is fast and straightforward.

- First, you have to create an account and verify your identity. The account creation takes five minutes, but identity verification can take up to 72 hours.

- After the successful verification, you will receive an email notifying you that your bank account is active.

- When you sign into your account, you must open an account or click on the already opened account to retrieve the account details.

- You can use the bank account number (IBAN for European accounts) to top-up your account from your other bank account.

- Depositing cash takes up to two days, depending on the account from where you are sending your money to Wise.

When your account is verified, sending and receiving money is very reliable. We have been using Wise for more than five years without any issues.

Wise Card Fees

While the Wise Debit Card is very affordable, there are a few fees you should be informed about.

| Service | Fee |

|---|---|

| Opening account | Free |

| Holding 50+ currencies & bank account details | Free |

| Sending EUR | Free with SEPA |

| Sending money outside of EU | From 0.41% * depending on the transfer type |

| Receiving non-USD funds | Free |

| Receiving USD funds | 4.14 USD |

| Ordering the Wise Debit card | 8 EUR, 9 USD |

| Express delivery (only EU) | from 18.4 EUR |

| Replacing the Wise Debit card | 4 EUR / 5 USD |

| Virtual Wise Card | Free |

| ATM withdrawals | 2 withdrawals per month of less than 200 EUR for free |

| 2 withdrawals of more than 200 EUR per month for 1.75% (2% in the U.S.) | |

| 3 or more withdrawals per month: 0.5 EUR per withdrawal + 1.75% of the amount over 200 EUR (1.5 USDT + 2% in the U.S) |

As you can see, the Wise Debit Card is a pretty good deal considering the value that you get. The only cost that might accumulate over time will occur if you are a heavy cash user.

While you are likely to pay cash-less in most countries, you will need to withdraw money which may become pricey in many developing countries.

Revolut Metal will be a better fit for you if you are sure you will need to withdraw from ATMs frequently. Compare the free plans between Revolut and Wise in our ultimate comparison Wise vs Revolut.

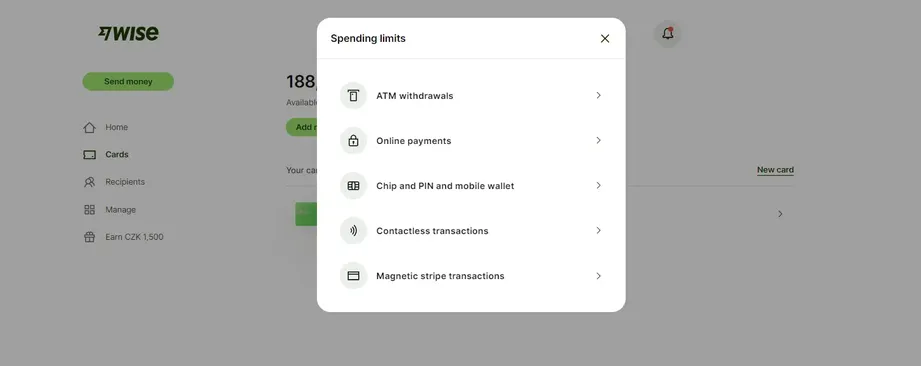

Wise Limits

The payment limit per transaction depends on the transaction type and your country.

We highly recommend navigating to the card section in your account and reviewing the spending limits for various card transactions. You can retrieve the default limit and change it if required.

Here are the limits for card transactions by EU-based users in EUR:

| Limit | Single Transaction | Day | Month |

|---|---|---|---|

| Chip and PIN and mobile wallet | Default: 2.500 Max. 10.000 | Default: 3.500 Max. 10.000 | Default: 10.000 Max. 30.000 |

| ATM withdrawals | Default: 1.000 Max. 1.000 | Default: 1.500 Max. 1.500 | Default: 3.000 Max. 4.000 |

| Contactless transactions | Default: 500 Max. 500 | Default: 500 Max. 1.000 | Default: 4.000 Max. 4.000 |

| Magnetic stripe transactions | Default: 300 Max. 1.200 | Default: 400 Max. 1.200 | Default: 1.200 Max. 6.000 |

| Online payments | Default: 1.000 Max. 1.000 | Default: 1.000 Max. 10.000 | Default: 2.000 Max. 30.000 |

And here, you can review the limits for card transactions by U.S.-based users in USD:

| Limit | Single Transaction | Day | Month |

|---|---|---|---|

| Chip and PIN and mobile wallet | Default: 1.000 Max. 2.000 | Default: 1.000 Max. 2.000 | Default: 5.000 Max. 15.000 |

| ATM withdrawals | Default: 250 Max. 1.000 | Default: 250 Max. 1.000 | Default: 1.500 Max. 6.000 |

| Contactless transactions | Default: 200 Max. 400 | Default: 500 Max. 1.000 | Default: 1.500 Max. 4.000 |

| Magnetic stripe transactions | Default: 1.000 Max. 1.500 | Default: 1.000 Max. 1.500 | Default: 1.500 Max. 6.000 |

| Online payments | Default: 1.000 Max. 2.000 | Default: 1.000 Max. 2.000 | Default: 2.000 Max. 15.000 |

Note that the default spending limits might change over time. You can always adjust your limits in the Wise App.

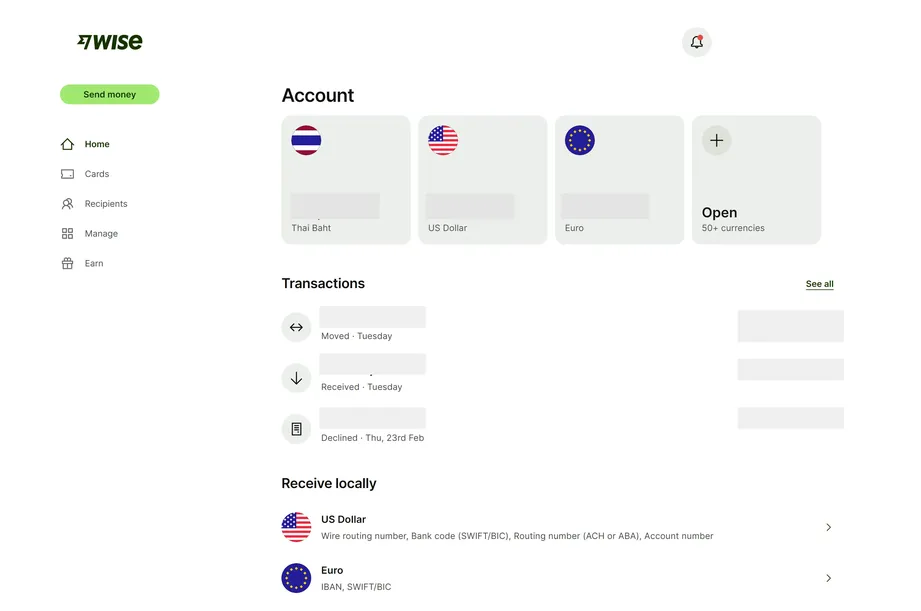

Wise App

The Wise App is intuitive and better than most banking apps offered by other banks.

Right after you login in, you can access all the essential information about your account.

On the left side, you can use the menu to:

- Send money

- Add new recipients

- Manage your account

- Manage your cards

In the main account overview, you can retrieve the balances of your active accounts and the latest transactions.

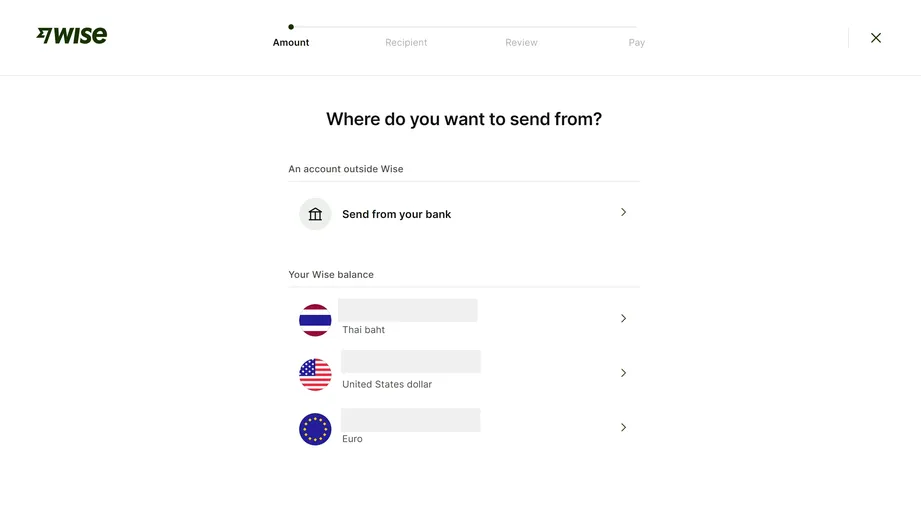

Sending Money With Wise

Sending money with Wise is very simple. Wise offers you two options:

- Send money from any of your bank accounts (suitable for multi-currency transfers)

- Send money from your Wise account (from your available balances)

It's important to understand that company also offers Wise money transfer services for users that don't have a Wise account.

The Wise money transfer service is used by several banks, including N26, as we have explained in our N26 review.

If you have topped up your Wise account and wish to send money from your balance, choose "Your Wise balance" and add the recipient to proceed with the payment.

Sending money is simple, and Wise will guide you through the entire process, which takes one to two minutes.

Wise Virtual Card

If you don't need to withdraw money from ATMs, you don't need to order any Wise Debit Card. Simply use the Wise Virtual Card instead.

You can use the card information to pay online or add it to your Apple and Google Pay app to pay in stores with your phone or wearables.

You can regenerate new card details at any time and save yourself some money for shipping a physical card.

Is The Wise Debit Card Safe?

Wise is licensed by the FCA in the UK and European users will get a Belgium IBAN. Since Wise is a payment provider and not a bank, your funds are not secured by a governmental protection scheme but instead safeguarded by Wise.

Your account is protected by 2-factor authentication, and often, you are requested to confirm transfers with your password. Outgoing online payments are always subject to verification from your end. Should your card get stolen or lost, you can immediately freeze it in your account.

You can also set up notifications on your phone to be informed about any activity on your account, which is quite convenient for many users.

As with any bank account, you should always access your dashboard from a safe device and follow the best practices to avoid bad actors accessing your account.

We believe that Wise offers sufficient protection for users' funds.

Final Takeaways

If you are still reading, the Wise card is a good fit for you. The Debit Card is affordable and extremely useful for anyone looking for a convenient way to store, spend and receive funds online.

Even if you decide not to use Wise as your primary bank account, the convenience that you get together with the cheapest way to send and receive money in different currencies is worth signing up for.

What are you waiting for?