Buyback Guarantee Explained

P2P lending has become a prevalent alternative investment method in the last few years, and if you’ve been keeping on top of the European P2P lending game, you will have come across the term ‘buyback guarantee". A buyback guarantee is a protection scheme offered on platforms that mainly list investment opportunities in unsecured personal loans.

In this guide, you will find out precisely what a buyback guarantee is and whether you should use it as a metric to evaluate and compare P2P lending sites. We will also show you the most popular P2P lending platforms with buyback guarantees.

What is a Buyback Guarantee?

The buyback guarantee is a security mechanism used by European P2P lending platforms. Mintos was the first mainstream P2P lending marketplace to introduce a buyback guarantee which allowed investors to sell their investments back to the loan originator once the borrower was late with a payment by over 60 days.

Can you rely on the buyback guarantee? Watch this video to find out:

Mintos Buyback Guarantee

Mintos offers a 60-day buyback guarantee for all its loans. This guarantee is provided by the lending companies that list loans on Mintos.

Mintos swapped the term "buyback guarantee" for "buyback obligation", which has the same meaning.

As we have witnessed over the past few years, Mintos has difficulties legally enforcing this buyback guarantee. Lenders like Varks, Capital Service, and many others offered a buyback guarantee for all of their investments until they stopped fulfilling their obligations to investors.

Even lenders with a seemingly good Mintos rating and provided a buyback guarantee have been suspended in the past, and investors' money was locked.

If you decide to invest your money on Mintos, you should not rely on the buyback obligation as many investors have already witnessed that this isn't real protection for their investments.

Why do Investors Choose to Invest on Platforms with Buyback Guarantees?

The buyback guarantee is a fantastic marketing tool that most European P2P lending sites offer to attract new investors. But why does this protection scheme increase investors’ trust in a platform?

The choice is simple. Would you rather see your delayed loans repurchased or defaulted? Most investors choose the first option, which leads them to look for platforms offering a buyback guarantee.

P2P Lending Sites with Buyback Guarantees

While many P2P platforms promote their buyback guarantees as protection schemes, not all of these buyback guarantees are the same.

On some platforms, the buyback kicks in after only a few days, while on others, it can take up to two or three months.

Let’s have a look at which platforms offer the greatest and the least protection through their buyback schemes:

| P2P Platforms with Buyback Guarantees | Reliability | Promoted Buyback Guarantee |

|---|---|---|

| Mintos | ⚠️ Not reliable | 60 days |

| PeerBerry | ⏰ Partially reliable | 60 days |

| Twino | ⏰ Partially reliable | 60 days |

| Swaper | ✅ Reliable | 30 days |

| Esketit | ✅ Reliable | 60 days |

| Robocash | ✅ Reliable | 30 days |

| Bondster | ⚠️ Not reliable | 30, 60 days |

| Income | ⏰ Partially reliable | 60 days |

| Viainvest | ⏰ Partially reliable | 30 days |

| DoFinance | ⚠️ Not reliable | 30, 60 days |

| Debitum Network | ⏰ Partially reliable | 90 days |

| Lendermarket | ⏰ Partially reliable | 60 days |

| Fast Invest | ⚠️ Not reliable | 3, 7, 15 days |

As you can see, the buyback guarantee or buyback obligation isn't being honored on all platforms.

✅ Reliable

Esketit, Swaper, and Robocash were the only platforms that could always fulfill the buyback guarantee.

⏰ Partially Reliable

Force majeure events such as the war in Ukraine harmed the performance of the loan portfolio on platforms like PeerBerry, Debitum, and TWINO. Those platforms were able to fulfill the buyback obligation in the past.

PeerBerry is the only platform that has activated the group guarantee and is repaying the war-affected loans to investors, while the other platforms are waiting until the embargo on transactions from Russia and Ukraine is lifted.

Some lenders on Income and Mintos are suspended, meaning the buyback guarantee isn't being honored.

VIAINVEST and Lendermarket are tricking investors into their loans which are being systematically extended, lowering the liquidity of investors' assets.

⚠️ Not Reliable

There are many failed platforms, such as Lenndy, Fast Invest or DoFinance, that followed a questionable business model. Bondster and Mintos are platforms where many lenders do not honor the buyback obligation.

Buyback Guarantee ≠ Safety

A buyback guarantee does not represent any serious protection of your investments. Many even fraudulent platforms offered (or are still offering) this guarantee while locking up investors' money.

Who Provides the Buyback Guarantee and Why?

In most cases, the buyback guarantee as we know it is provided by loan originators rather than platforms themselves. This means that particular P2P lending platforms are not directly responsible for fulfilling their buyback guarantees.

On P2P lending marketplaces such as Mintos or PeerBerry, the loan originator repurchases the investor’s claim against the borrower.

This isn't the case on Mintos anymore, as the platform no longer offers investment in claims but in financial instruments.

This means that the default risk shifts from the investor to the loan originator. Simply put, as an investor, you get the money back while the loan originator takes care of the debt collection.

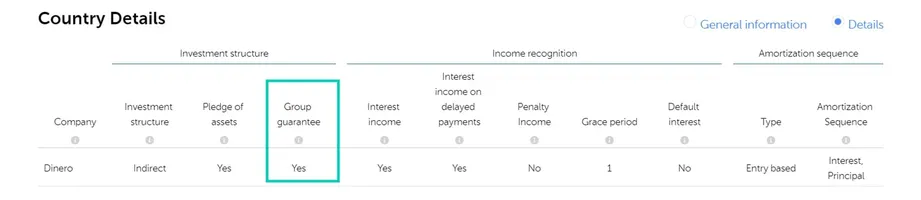

What is Group Guarantee?

In some instances, large loan providers operate their own P2P lending platform, which gives them access to additional funding for their loan portfolios. On some marketplaces like Mintos or PeerBerry, large loan companies offer an additional buyback guarantee for their loan originators.

This means that if the loan originator cannot cover the buyback guarantee on its own, the parent company (which usually has much more significant financial resources) will cover this obligation.

This sounds great in theory, but a group guarantee on Mintos doesn't mean much. PeerBerry is the only platform that executed the group guarantee and has repaid most of the affected loans back to investors.

Small Details that Influence Your Returns

Most investors don’t pay too much attention to the terms that apply to the buyback guarantee.

You should, though; the finer details can cost you significant return losses or gains.

For example, while most platforms offer a buyback guarantee that covers the accrued interest for delayed payments and a penalty fee, this is not always the case.

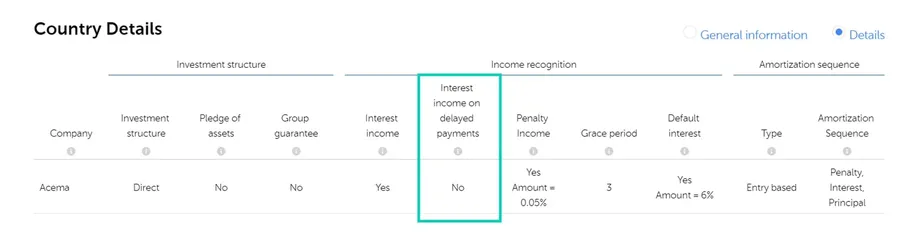

Here is a screenshot from Acema: an established loan originator based in the Czech Republic. While this loan originator has an exceptional track record and lists loans on P2P lending giants like Mintos and Bondster, their buyback guarantee terms often don’t work in favor of the investor.

If you, as an investor, invest in loans from Acema and the borrower is late with their payments, you will receive a penalty fee of 0.05% but no interest.

Let’s use an example to understand the severity of this situation clearly:

Imagine you have invested a few thousand euros in loans from Acema, and a few of them are delayed; you could have up to two months where your money won’t earn you any interest!

To avoid this situation, we suggest going through every loan originator on Mintos and setting up your auto invest in a way where you exclude loan originators that don’t pay interest on delayed payments.

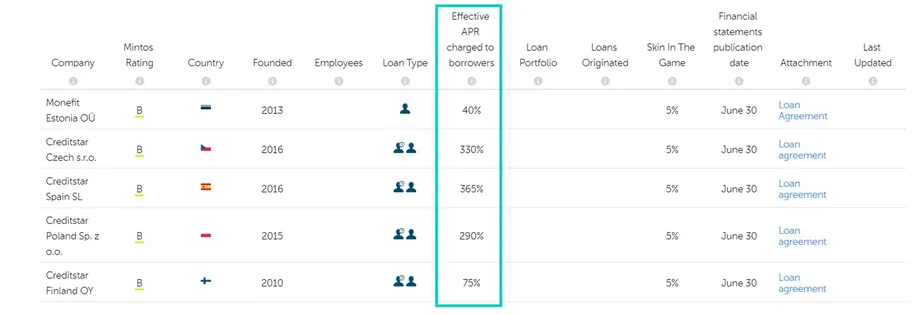

Who Pays For The Buyback Guarantee?

So, someone has to pay for the buyback guarantee: the defaults and cost of loan collection. To fund the buyback guarantee, the loan originators take a cut of the borrower's interest, which means investors indirectly pay for the buyback guarantee as they receive less interest.

P2P lending is a significant funding source for short-term loans with interest higher than 100% per annum. You, as an investor, will get approximately 10% interest, and the P2P lending platform takes a cut while the rest remains with the loan originator.

When you click on the loan originators on Mintos, you can see for yourself how much the company charges for their loans.

P2P loans covered by the buyback guarantee tend to have lower interest rates than those without a protection scheme.

This means that loans that aren’t backed by a guarantee tend to have a much higher interest rate and default rate.

If you want to give a platform without a buyback guarantee a try, sign up on Bondora - the most popular platform for investments of this nature.

Can You Rely on the Buyback Guarantee?

The buyback guarantee gives many new P2P investors the impression that there is no way to lose money through P2P lending, as the loan originator or the platform will always repurchase delayed loans.

Don’t be fooled, as this is only an illusion.

The buyback guarantee does not by any means ensure that your money is 100% secured. Remember, you are investing in unsecured loans on most platforms offering a buyback guarantee.

While the buyback guarantee works in normal market conditions, where the demand for P2P lending is increasing, it’s not bulletproof.

External Factors

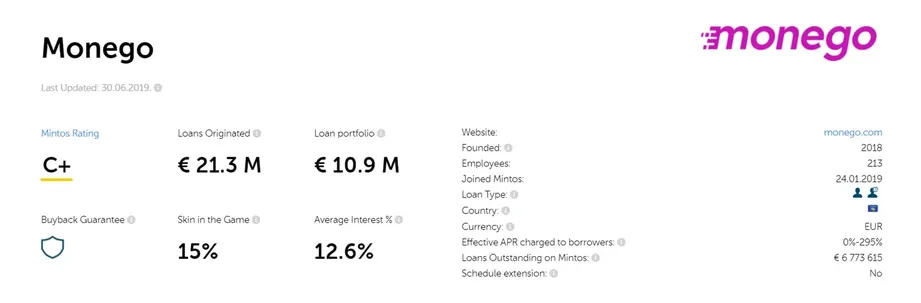

External and macroeconomic factors can have a significant negative impact on loan originators. Kosovo’s Monego, one of the famous loan originators on Mintos, lost its license to provide loan services. As a result of this political decision, Monego had to close its business.

Thousands of investors are now waiting to receive their money back. Mintos recently announced that the first tranche of funds should be distributed to Mintos investors in April 2020.

To date (January 2023), there are still €1.7M of investors' funds locked in Monegos' defaulted loans.

While Monego offered a buyback guarantee, there is no absolute guarantee that investors will receive all their money back.

Scams

Unfortunately, the hype around P2P lending attracted a few platforms that exploited this opportunity and stole millions of euros from fellow investors.

At the beginning of 2020, two platforms Kuetzal and Envestio disappeared with investors’ money. On Envestio alone, investors lost over €33 million, and guess what? Envestio also offered a buyback guarantee.

It’s not easy to spot scams immediately, so every investor should do their due diligence and decide whether they want to invest on a platform.

We at P2P Empire regularly update our P2P lending reviews to give you the most accurate and factual information.

The P2P lending space is, however, changing rapidly, and even we cannot always guarantee 100% accuracy of our data, as (while we do try!) we cannot track all of the changes to P2P lending sites’ terms and conditions.

Review our newsfeed to be updated about the latest developments in the industry!

Final Takeaway

A buyback guarantee isn't worth much if the platform or lender isn't honoring it. Investors can take this feature as an additional benefit that a platform is offering.

It should certainly not be a key criterion for investors, and one should not blindly rely on marketing statements that promise the ultimate protection of your investments. In many circumstances, it's just deceptive marketing, aiming to lure investors' money to fund a non-performing loan book.

Doing your own research and regularly tracking your investments can help save your investments.

Remember that diversification across trustworthy platforms and various loan types is generally a much better investment strategy than investing solely in loans that are covered by a buyback guarantee.