N26 Review - After 6 Years

Are you looking for a modern banking experience that fits your lifestyle? If so, the N26 bank might be worth considering. In this review of N26, we’ll take an in-depth look at the features and services offered by this digital bank to help you decide if it is right for you.

We’ll cover topics such as N26's safety, mobile app offerings, customer service options, and more. By the end of this review, you should better understand whether or not using N26 would benefit your financial needs.

What is N26?

The N26 is a licensed bank in Germany that launched one of the first mobile banks on the market. Today the bank offers its banking app to users from all over Europe looking for a modern and well-built mobile baking experience.

N26 Overview

- Get a german bank account

- Mobile-first banking experience

- Cheap transfers in foreign currencies via Wise money transfer

- Low fees

Are you ready to embrace the mobile banking experience with N26?

N26 Pros And Cons

As with any bank account, there are always pros and cons that you should consider before registering.

Pros of N26

- Free bank account

- Three product tiers with various features

- Unlimited free ATM withdrawals in the EU

- Free virtual card

- Regulated in Germany

Cons of N26

- Cards can only be sent to your home address; if you lose your card abroad, N26 won't be able to deliver you a new one

- The differences between some of the N26 accounts are marginal

Who is the N26 bank account suitable for?

N26 suits anyone looking for a bug-free mobile banking app to manage their finances and save, send, and receive money. It's suitable for anyone living an international lifestyle. If you often send money in different currencies or travel to various countries, N26 is one of the best banking products on the market.

Who can apply for the N26 debit card?

Anyone over 18 years old who resides in the following countries is eligible to open an N26 bank account and order an N26 card: Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Liechtenstein, Luxembourg, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland.

The N26 bank account isn't available for Non-European residents.

Suitable bank for P2P investors

N26 Bank GmbH is also a suitable digital bank for European P2P investors who wish to open a free bank account. Most European P2P lending platforms require investors to send money from a EUR bank account. The N26 bank is a suitable option to consider.

How to open an N26 bank account?

Opening an N26 bank account is straightforward and can be done online within ten minutes. Click here to get started.

- Select your country of Residence

- Insert your personal information, mobile phone, home address, and tax information, and create a password

- Download the app

- Verify your identity

- Approve your account and order your N26 account

While the application is speedy, verifying and activating your account may take a few hours or days.

N26 fees

When it comes to banking services, fees are often an essential factor to consider. The N26 bank offers a free service for users who want to use virtual cards.

You must pay a monthly fee for a physical card or additional features.

If you want to open an N26 bank account, the fee you will pay depends on the account type you will sign up for and the service you will use.

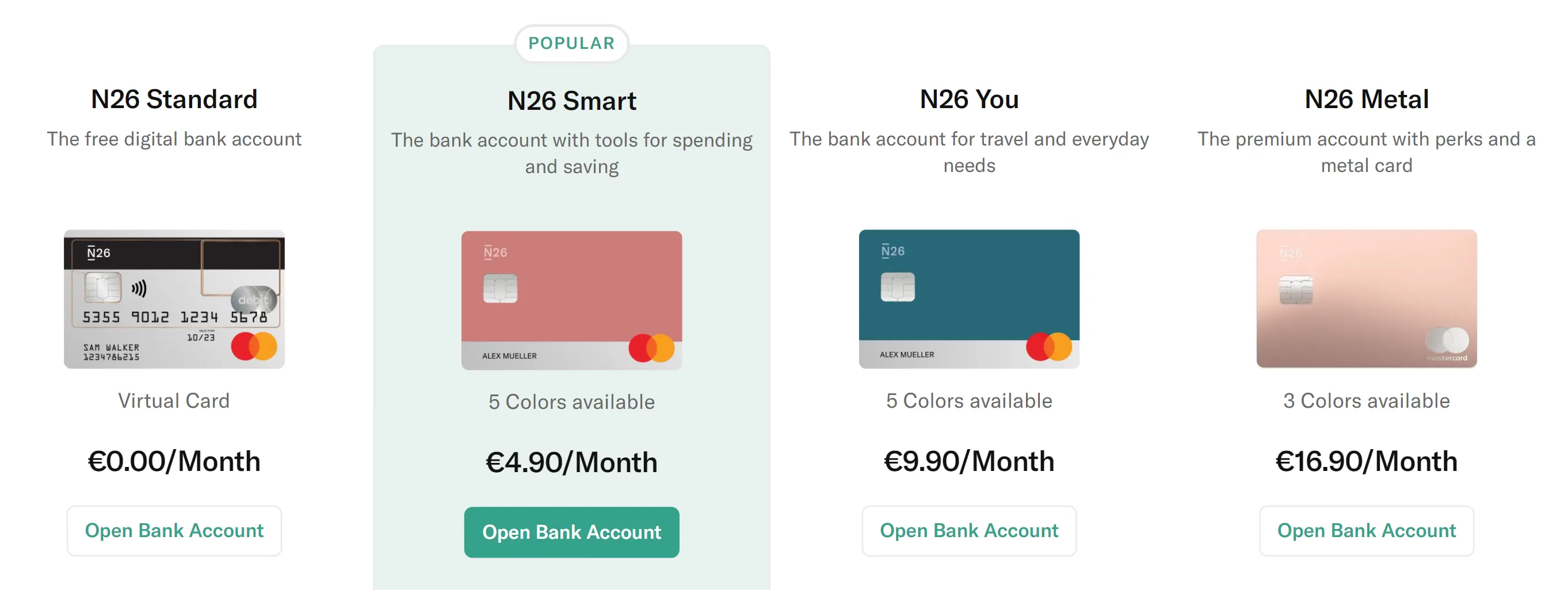

Here is a breakdown of account types as well as fees to consider.

N26 Standard

N26 Standard is a free N26 bank account with a free virtual card and an optional physical card which costs €10.

This bank account offers the following features:

- Free virtual card

- Free contactless payments

- Mobile payments

- 100% mobile banking

- Free payments worldwide

- 3 domestic ATM withdrawals

- Unlimited domestic cash withdrawals with CASH26 partners

- Unlimited free ATM withdrawals in the EU

- In-app chat

The N26 Standard account is excellent for students or users seeking essential banking services.

This account offers only three domestic ATM withdrawals for free. If you need more, you will have to pay a €2 withdrawal fee in your home country. Alternatively, you can use CASH26 retail shops in Germany without any limitations for free.

The CASH26 retail shops can be located through your N26 banking app.

The total cost for N26 Standard will be €10 for the optional card and €2 ATM withdrawal fee if you exceed your three free domestic ATM withdrawals.

N26 Smart

N26 Smart bank account will cost you €4.90 per month. A physical debit card is included in the monthly subscription price. In addition to the perks you get with N26 Standard, you will also benefit from the following:

- 5 free domestic ATM withdrawals

- Phone support

- Access to "Spaces" which is a savings feature in the N26 app

- Free debit card in five different colors

The N26 Smart does only give you two more free domestic ATM withdrawals and the free debit card available in 5 color variations. The N26 Smart debit card will only pay off if you use the five free ATM domestic withdrawals.

N26 runs a 2-month Smart free trial promotion for all Standard users, so if you sign up, you can access this promo from your phone.

The annual cost for the N26 Smart in the first year is €49 if you use the 2-month free trial and continue paying for the remaining ten months every month.

If you decide to pay for the annual subscription immediately after your 2-month trial, you will get a 20% discount, meaning you pay around €47 for 14 months.

If you know that you will use at least 5 ATM withdrawals in your home country, then the N26 Smart is a much better deal for you.

N26 Standard and N26 Smart users will have to pay a 1.7% ATM withdrawal fee for withdrawals abroad.

N26 You (Editor's Choice)

N26 You is the perfect bank account for travelers who seek additional perks such as travel insurance and free ATM withdrawals worldwide.

The N26 You account offers the same perks as N26 Smart but also:

- Free ATM withdrawals abroad

- Best currency exchange rates

- Medical travel insurance

- Travel cancellation insurance

- Pandemic travel coverage

- Flight insurance

- Luggage coverage

- Mobility Insurance

- Winter sports insurance

The most significant benefit of the N26 You account is free ATM withdrawals worldwide. This is handy if you travel a lot, as not every country is as cashless as western Europe.

Not only are you not being charged any fees from N26 to withdraw cash abroad, but you will also get the best exchange rate if you let N26 make the conversion and not the local ATM machine.

Depending on your usage of this feature, you can likely pay the subscription price back with just the ATM withdrawals. N26 You also offers a list of travel insurance perks if you pay for your trip with your N26 bank card.

Especially the insurance for travel and flight cancelations, delays, and luggage coverage is useful in unexpected travel situations.

The insurance package is provided by Allianz Assistance and covers the following:

- Medical insurance up to €1,000,000 for you, your partner, and your kids in case of emergencies

- Compensation of up to €500 for flight delays over 4 hours.

- Compensation of up to €500 for baggage delays over 12 hours and up to €2,000 if it goes missing.

- Trip cancellation or curtailment up to €10,000.

The N26 You account costs €9.90 per month or €95 per year if you are opt-in to pay the annual fee upfront.

The N26 You account is likely your best option if you are a frequent traveler.

N26 Metal

N26 Metal is a premium N26 bank account with a metal debit card. This subscription plan offers the same features as the N26 You plan with the following additional perks:

- 18-gram metal card

- 8 Free domestic ATM withdrawals

- Phone insurance of up to €1,000 for mobile theft and damage

The price of the N26 Metal is €16.90 per month if you choose to pay monthly or €162 for the annual plan. You essentially save €40 by opting for the yearly membership.

The value you get from the additional cost of the N26 Metal compared to N26 You isn't worth it, in our opinion. The metal debit card is more of a status symbol as it doesn't provide any enhanced functionality compared to a plastic card.

If you don't need three additional free domestic ATM withdrawals and mobile insurance, the N26 Metal isn't worth the added cost.

Fees for Incoming SWIFT transfers

While SEPA transfers are free, N26 bank will charge you €12,50 + 0,1% of the transaction amount for any incoming SWIFT transfers. You will be charged this fee independently from your subscription.

N26 Banking App

The N26 banking app is available for mobile and desktop devices, although most users will likely only use it on their phones.

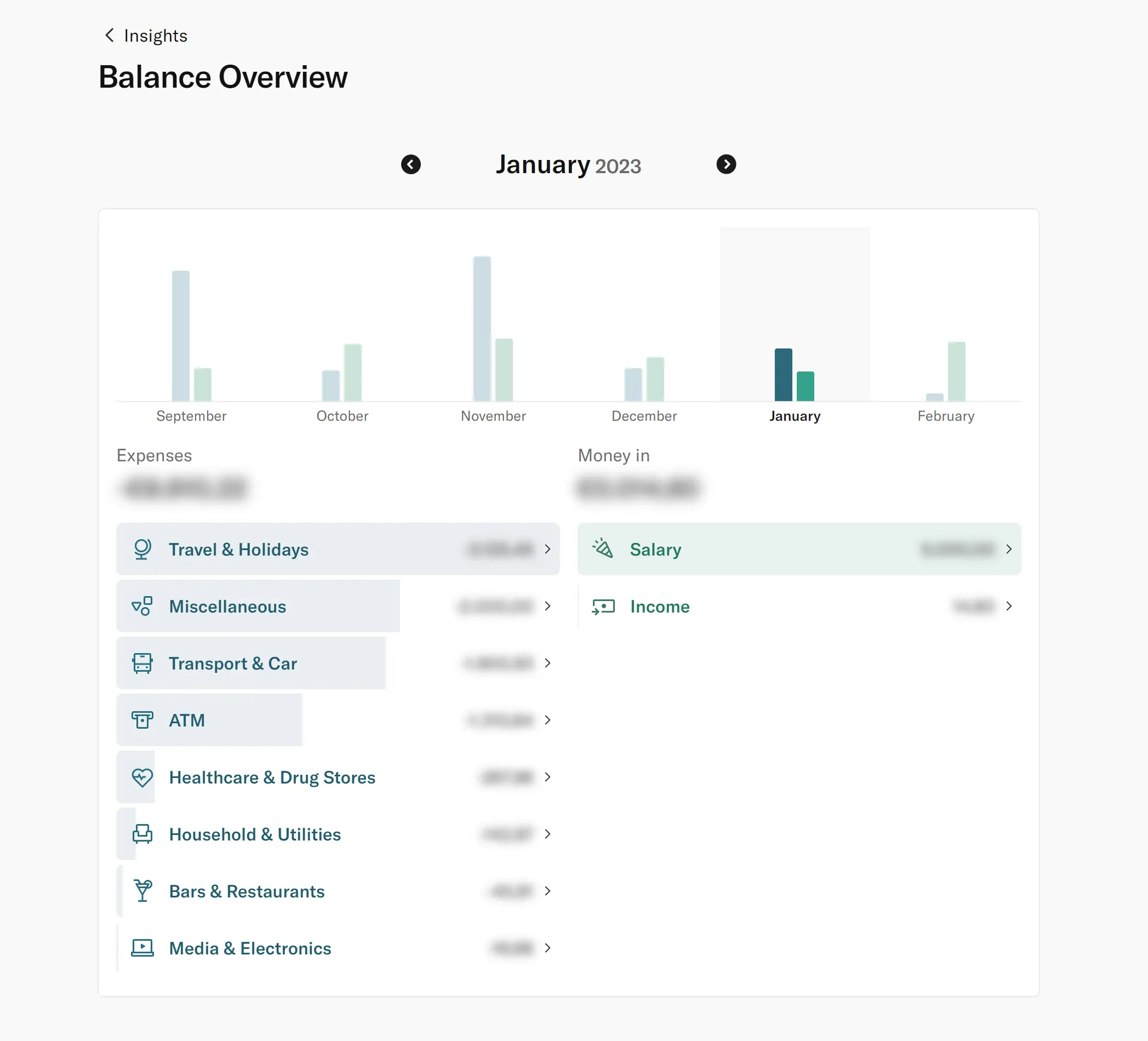

The app offers a handy overview of your spending, balances, and transactions.

You can quickly locate your recent transactions, top-up your account, send money, or schedule transfers.

As with every modern bank account, you can easily download bank statements. The usability of the N26 bank is superior to most traditional banks.

The N26 banking app does a great job of categorizing your expenses and managing your monthly budget. It can also be used as a budgeting tool that helps you keep track of your finances.

N26 Spaces

N26 Spaces is here to help you put money aside for trips or future expenses. It's a handy tool that will help you save money without even thinking about it. You can imagine it like a digital piggy bank.

N26 Spaces also support "round-ups" that automatically round up your expenses and save the change in a dedicated space.

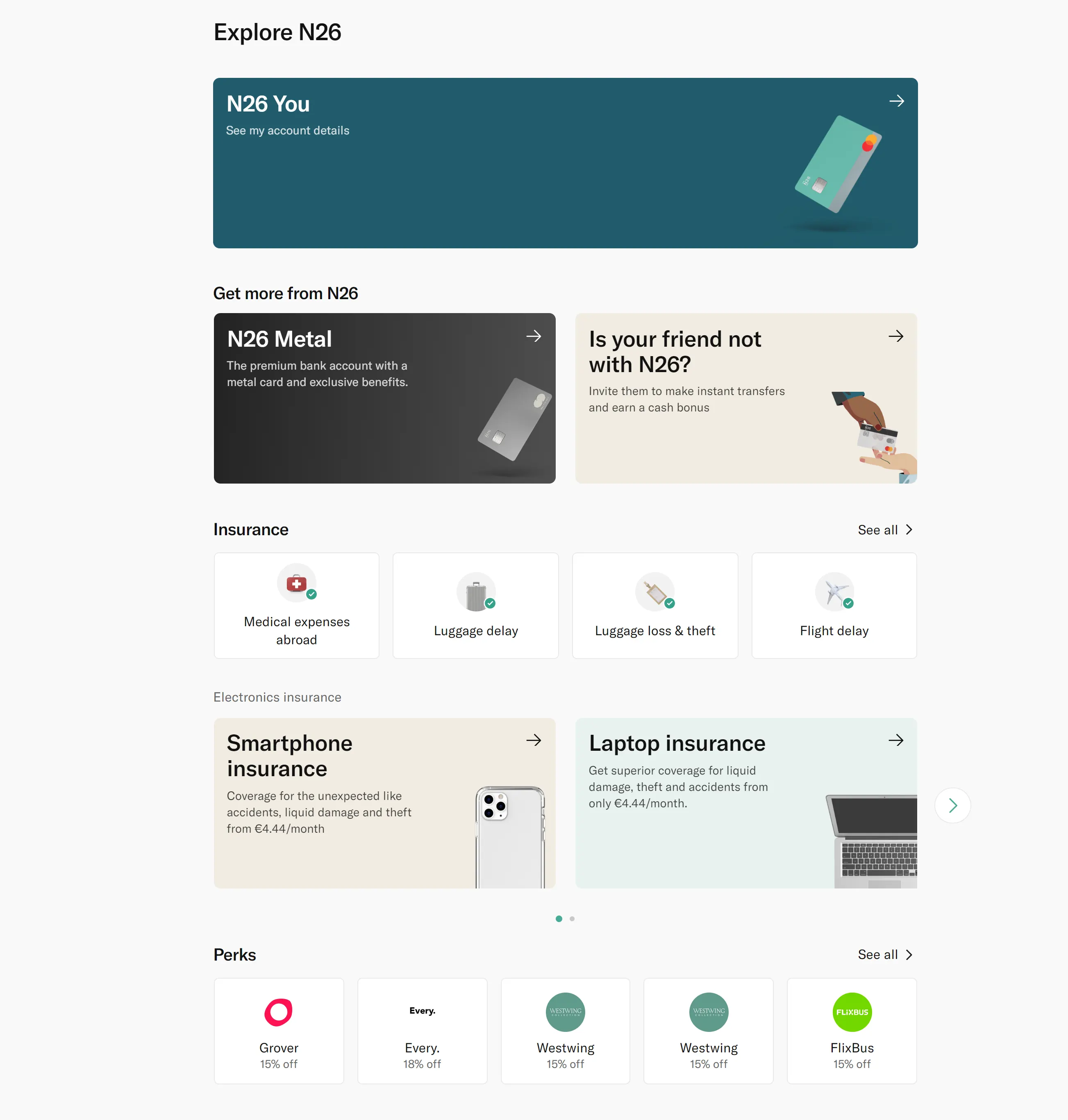

Perks And Insurances

N26 premium users can also benefit from various insurances and perks that N26 offers. You can find it in your app's "Explore N26" section.

This is also the view where you can file an insurance claim or explore other products that N26 offers.

Overall the N26 banking app offers all you might need from a mobile-friendly digital bank.

N26 Business Account

N26 also offers an N26 business account for freelancers with a 0.1% cashback on all card purchases.

The account offers a dedicated debit card and five free ATM monthly withdrawals. You can pay in any currency; the bank won't charge you for foreign transactions.

The N26 business account offers similar budgeting features and statistics as the regular N26 bank account. The business account offers a handy feature that uses "Spaces" to set money aside for tax payments. This account also supports SEPA Instant Credit Transfers for speedy payments.

The N26 business account is made for freelancers or self-employed people and can provide an excerpt from a business registry.

N26 offers the same free and premium tiers as personal accounts.

The N26 business account is available for freelancers from Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Liechtenstein, Luxembourg, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland.

Unfortunately, N26 doesn't allow users to simultaneously own personal and business accounts. You can either get a personal or business account.

While there is a workaround for this, and N26 offers a Meastro card for personal expenses, we don't think it's worth it, considering the cost and the usability of Meastro cards.

Is N26 Safe?

N26 is a regulated German bank, meaning that the deposit protection scheme protects your money up to €100,000.

The banking app offers a variety of security features such as passwords, PINs, two-factor authentication, and biometrics. You will also be asked to verify your login or any outgoing payments.

The N26 app allows you to enable notifications so you can be constantly updated about any activity on your account.

We have been using the N26 bank for more than six years, and we haven't had any issues with the app. Customer support is available through in-app chat, so you can ask for help within just two minutes directly from your phone should you ever need assistance.

Final Takeaways

N26 is an excellent choice for an affordable and convenient digital banking experience.

With great features like a mobile app, low fees, and free international transfers, it’s an excellent option for those seeking an alternative to traditional banking.

If you sign up and opt-in to one of the paid plans, we suggest the N26 You annual membership. This plan offers excellent value for money, especially if you travel frequently.

Ready to manage your finance with N26?